For anyone who has visited New York in the past few months, you’ll understand.

If you walk on the streets of NYC on any given day, they are packed! Subways are overflowing. Restaurants are overworked and understaffed. Even the candy-coated peanut guy is moving units.

On the surface, there is no worry or care on the thousands of faces that cross my path every day.

Of course, that’s not entirely true. I’m sure they all have a million things to worry about … like directions to take Instagram pictures in front of a certain landmark.

Yet it doesn’t seem like the state of the economy is one of those worries.

So why is everything I read these days trying to convince me that consumers are so hopelessly bearish right now?

-

- Because AI is going to take your job?

-

- Because, after 74 previous incidences, each ending the same way, the US could finally be on the brink of defaulting on its debts.

-

- Or, because we’re all on the edge of our seats waiting for the next rate-hike-induced shoe to drop. Waiting for jobless claims to ramp up, while everyone working from home is on drugs, and commercial real estate falls through the floor?

Maybe that last one is a little far-fetched, but of course, these issues are no slouch. Unemployment can be destructive to an entire family and can leave kids with traumas for a very long time. I know people who are still struggling to cope with what happened to their parents in ‘08.

Hell, cryptocurrencies aren’t even out of their infancy yet. Now, the AI space is growing rapidly, and we haven’t even begun to truly understand the good and bad ramifications of this tool.

And most importantly, the US government is one week out from running out of reserves to pay our bills.

All signs point to a crisis on our hands.

But what if things aren’t as bad as they say they are?

As the great Sam Ro put it:

“The economy is actually in good shape but the news is giving consumers the perception that things are bad… the economy consumers are actually experiencing is much stronger than the economy they are perceiving.”

Almost every bit of financial media I read is trying to convince me that you all—we—are scared shitless for the future. Quoting “experts” and top executives who are all but too sure a recession is only imminent. For months now, they’ve been pushing the potential for a recession from Q1 to Q2 to Q3 to 2024.

Here are four charts to change your mind on why things aren’t as bad as they want you to believe.

Most People Have Confidence the Debt Ceiling Will Be Solved

How do you believe the US debt ceiling will be resolved? – JPM client survey pic.twitter.com/eYjEb49j9a

— Sam Ro 📈 (@SamRo) May 17, 2023

Although this political Game of Chicken has dragged on for too long, most people still believe we will ultimately raise the debt ceiling and pay our bills. Unlike everyday people like you and I, the U.S. government has a power that we don’t possess. They can raise their own credit limit and print more money anytime they spend too much. Oversimplified, maybe. But there really is only one way to see this situation through or risk a technical default that would stun an otherwise healthy economy.

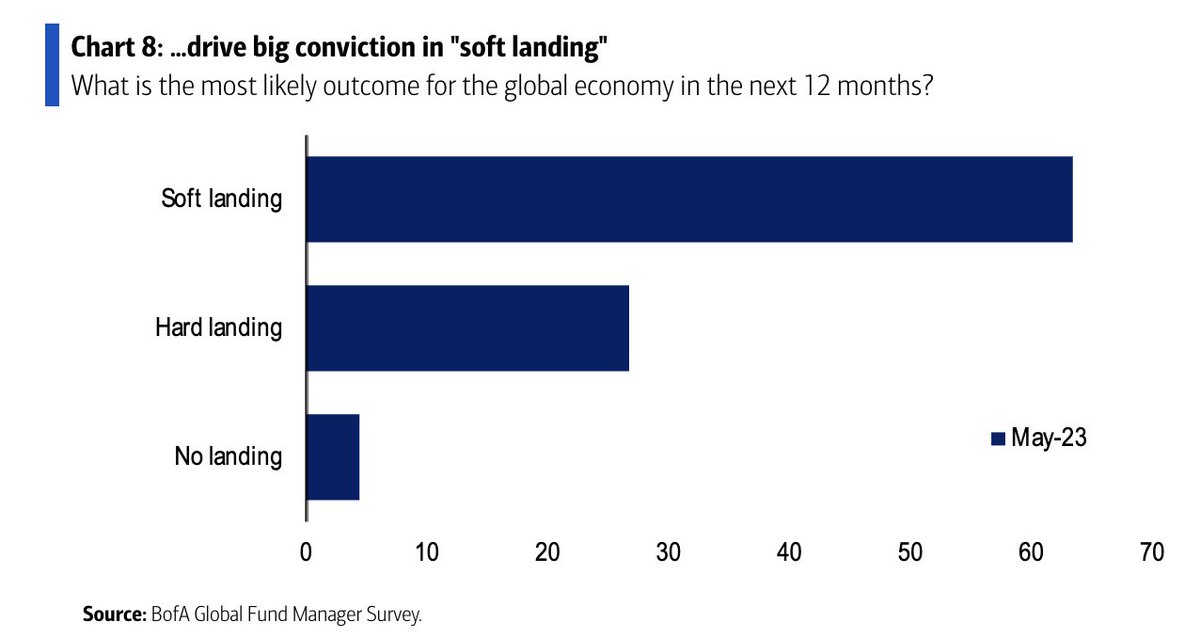

The Soft Landing Is No Longer a Pipe Dream

A soft landing is “where inflation cools to manageable levels without the economy having to sink into a recession.”

My initial reaction to the month-over-month data being released has been that—inflation, the supply chain issues, the tight labor market—are all showing signs of slowing down or improving slowly but surely. And isn’t that the outcome we would much rather have? If the sweet spot is for inflation to reach 2% but unemployment has to be 4.5%? 5%? 5.3%? wouldn’t we want that to happen bit by bit rather than overnight? ZipRecruiter is suggesting 79% of laid-off tech workers found a job shortly after their separation.

Powell mentioned at the early onset of the inflation battle that there would be pain. If that means a choppy stock market and a slip-n-slide out of tech when AI is chasing down jobs like DK Metcalf, I’ll take my bruises.

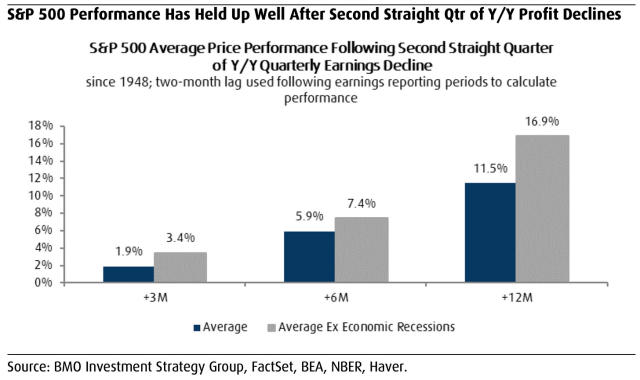

The Market Can Shrug Off an Earnings Recession

An earnings recession is said to be two-quarters of negative year-over-year quarterly earnings. One of the other latest fears is that stocks are still overvalued and a battered, inflation-hungover consumer would depress earnings for businesses. Although 62% of companies beat their earnings estimates last quarter, y/y first quarter numbers still came in negative at -0.1. However, BofA and BMO did studies on both the economy and US equities following an earnings recession. Bank of America found that four of the last seven earnings recessions did not coincide with an economic recession. In fact, the S&P 500 was on average positive three, six, and twelve months after an earnings recession.

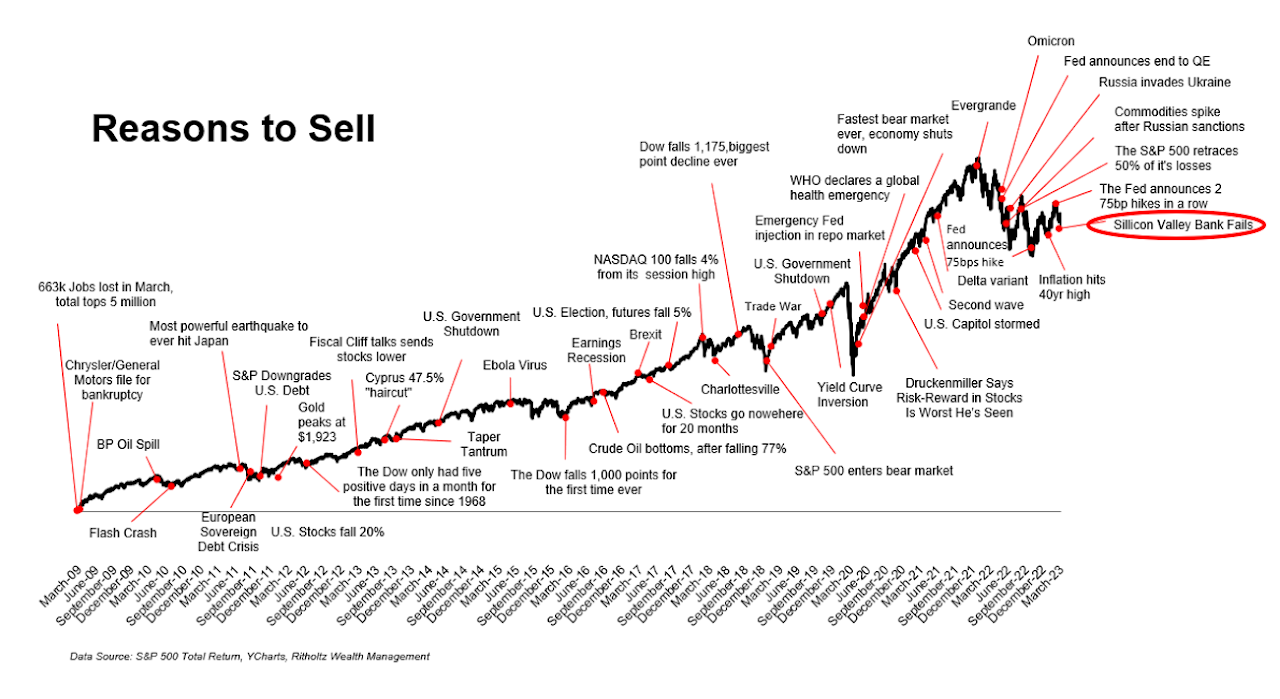

There Is Always a Reason to Sell, Doesn’t Mean You Should

Ro leaves us with the following:

“In my years of working in financial news, itʼs been my experience that bad news clicks far better than good news. Generally speaking, news companies are out there to answer readersʼ questions and address their interests. And the data suggests people are interested in bad news.”

Lastly and biasedly, I’ll end with one of my favorite charts. I don’t need to be the one to tell you that this game is hard. You know that. This chart is so powerful because each event is terrifying in the moment. It’s hard to see beyond the horizon when you’re fanning through the smoke. It’s also hard to see the progress a few months out when it feels like you haven’t really gone anywhere. But if you’re an investor, not a trader, you know it takes time. And thanks, Mr. Powell, but we already knew there was going to be pain ahead. We signed the waivers. We know the risks.