Just for a moment, I want you to take everything that happened in 2022 … and throw it out of the window.

If I had to describe this year in a few words, 2023 was the year of the fighter.

We kicked off the year with the possibility of defaulting on our national debts. Across all sectors, nearly all of the Q1 earnings guidance was negative. Then bam! A banking crisis. SVB, Signature Bank, First Republic. They wanted to know if Charles Schwab was next! Nowhere was safe. People began questioning FDIC insurance.

In the backdrop, the Fed pulled interest rates up from the mud at the fastest pace in history. Still, there were good and bad coming out of this higher rate regime. However, the consensus was that the consequences were skewed toward the bad.

But despite the gloom, the economy resisted every call for a recession, whether deep, moderate, or slight.

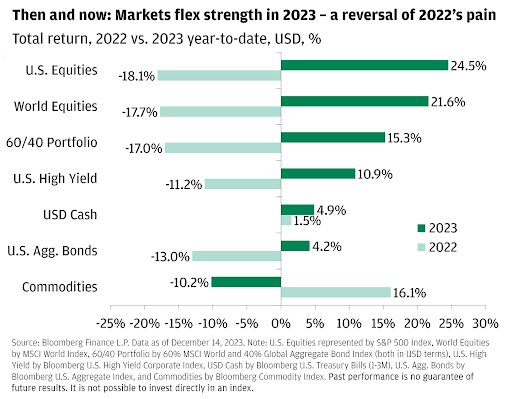

Higher rates, a weapon in this battle, were expected to impact these sectors very differently. Look how that turned out:

Fidelity Investments, Sector Research

Fidelity Investments, Sector Research

The resilience displayed by each of these sectors showcased the year as a testament to the fighting spirit.

In the whirlwind of economic turbulence that defined 2023, resilience emerged as the defining trait of the year—the year of the fighter.

Now, as we bid farewell to this year’s challenges (and triumphs), the spotlight turns to the strategic decisions investors face:

Does more safety make sense given risk-free yields? And given all the benefits cash now holds, is cash fair competition to bonds?

Choose Your Fighter: Cash vs. Bonds

Is it wise to hold more cash— or to reinvest maturing Treasuries into the next—rather than dealing with the stomach-churning ride you get with investing that money in assets that don’t provide the same guarantee?

It’s important first to evaluate your liquidity needs.

For starters, cash is king. Providing immediate liquidity and a known value. Money market funds add an enticing layer to the cash conversation, offering yields upwards of 5%.

On the other hand, bonds can be simple. You can think of them as safety and support in the portfolio, too, but understand there are risks. Not to rehash 2022.

Still, despite the allure of cash yields today, resist the temptation of viewing it as a replacement for essential components within a portfolio.

Jean Keener CFP, CRPC, advocates for a bucketing strategy based on the time horizon for the invested funds. Expenses within a year (or a year and a half at most) are deemed suitable for holding in cash.

However, if you’re hoarding 5 to 6 figures in cash with no intended use because “I’m getting a pretty good rate on it, why touch it?” you could be missing out on big opportunities, even if they’re less obvious than years prior.

Note that cash can serve as a source of income, too, but it doesn’t provide the long-term growth potential of other investments.

Looking forward, let’s say we actually pull off a soft landing, and the Fed decides to cut rates given that we’ve reached our target. The bonds you locked in will continue to pay what they’re paying. However, cash will quickly follow suit with short-term rates

Vanguard, Morningstar, and I’m sure plenty of others I’m leaving out are calling for rate cuts in 2024.

Of course, we have no idea what’s going to happen. If nothing is broken, the economy keeps humming along, and inflation remains stagnant, the Fed could decide to sit on their hands in the new year. However, Jay Powell did hint that there could be as many as three cuts next year.

If rate cuts do materialize, 2024 could mark another historic year for bonds, but this time for the better. Bond yields bought today would remain stable, yet the price of those bonds may appreciate significantly, offering both income stability and growth.

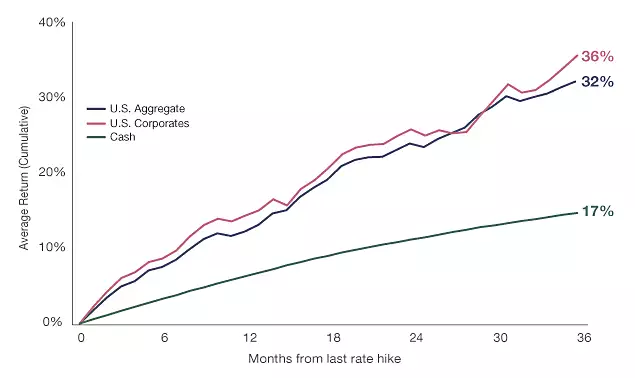

To that point, Adam Schrier, CFA at New York Life, highlights that being early makes a meaningful difference. Following the last rate hike—which includes rate cuts as well—the aggregate bond index and investment grade bonds pummel cash over a 36-month period.

The tradeoff for safety is that cash doesn’t rally. Cash would quickly adjust to short-term rate changes. Meaning when short-term rates begin to decline, so too will the rate on your cash.

Even though equities are tickling all-time highs, it doesn’t mean you’ve missed out. One of cash’s strengths is flexibility and being able to be deployed at a moment’s notice.

“The last time the Fed lowered interest rates pre-emptively (in 2019), the S&P 500 rallied about 30% and investment grade bonds returned nearly 9% that year,” JPM Global Investment Strategist writes.

The Curtains Come to a Close

As we wave goodbye to the challenges of 2023, this year’s financial landscape has proven that adaptability and strategic thinking are key.

Thank you, 2023, for allowing us to feel a bit more like “normal.”

Although, for the first time, at least in my career, we are seeing cash yield enough to actually make saving enjoyable, dare I say.

And as much as I’d love this to be the simple solution to our investing qualms, 2023 proved that it’s never that easy. Just when you feel like you’re comfortable making 5% on your money and calling it a day, the S&P is up almost 25%, the Q’s more than 50%, and longer duration bonds touching 6% yields.

The options on the table were crazy!

This is obviously not to say cash is not important—especially in a retiree’s portfolio—but it always comes down to sizing and time frames.

Looking back, this year was truly the year of the fighter. I just hope you chose your fighter wisely.

Thanks for reading and Happy New Year!