It goes without saying that not all of my client meetings are a delight where I get to tell clients how wrong pundits were about the economy. Or pointing out how much Nvidia and Microsoft they own in their portfolio.

Occasionally these talks are grim and can be uncomfortable.

To show you what I mean, one cloudy, sticky Wednesday afternoon, a client told me about his childhood best friend passing away.

A father of two boys and in fairly decent shape, this was the last thing he expected from his friend. He had a heart attack in his backyard, and unfortunately, his heart never stabilized.

To close the loop on his story, he asks me: do you think I need a Will?

If you’re ever pondering this question, I’ll make it easier on you. You really only have two alternatives: a Revocable Living Trust (more on this another day) or nothing—letting your state law decide what to do with your property and life’s savings.

And I don’t know too many people fond of this idea.

This article covers the iconic late artist Whitney Houston’s Will and the lessons to learn when understanding why, at minimum, a Will is necessary for everyone.

Since I got so many positive reactions to my article on Amy Winehouse, I wanted to dive into another famous example of what to understand when it comes to developing an estate plan.

Whitney was a true legend and musical goddess for all races and generations. I don’t know a single person who doesn’t know or like a Whitney Houston joint.

The Newark native is the elite artist behind some of my personal favorites like It’s Not Right But It’s Okay, Saving All My Love For You, I Wanna Dance with Somebody, and How Will I Know.

And, of course, you know her #1 hit record, I Will Always Love You.

Despite the angelic music she blessed us with, she, too, struggled with a life of some pretty hard drugs and an infamous troubling marriage.

Whitney Houston passed away in 2012 in Beverly Hills, California. Thousands of miles away from her home in New Jersey. And it pained me to discover that her 22-year-old daughter, Bobbi Kristina Brown, had the same fate only three years later.

These are four lessons I learned following the events of Whitney Houston’s death.

Lesson 1: A Will is Public Information

For starters, a Last Will and Testament (most known as a Will) still has to go through probate court when you’re gone and is a matter of public record. Meaning anyone with internet access might be able to see it.

For example, we can read all of her final wishes right here.

If you don’t speak legalese, the TL;DR of the document states that she left her entire estate to her daughter, Bobbi Kristina Brown.

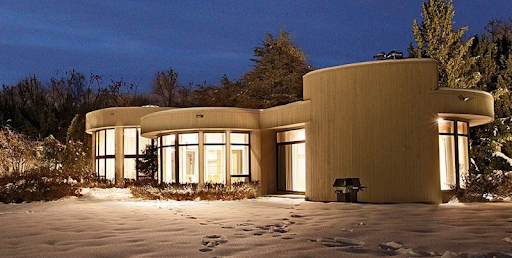

Including her real estate (notably 22 North Gate Road in New Jersey), cars, personable belongings, and record royalties — said to be in the multi-millions, albeit in a Testamentary trust. A trust created by the Will or at death.

22 N Gate Rd, Mendham, NJ

A Will is a powerful document and the cornerstone of every estate plan. However, it does have its nuances.

Amongst those nuances is that it is public record and could be accessed by probing and, perhaps, predatory eyes. You don’t have to be famous not to want ambulance chasers and scammers bugging your beneficiaries.

It’s also worth acknowledging the grieving process is different for many people. But even so, losing your mother is an incredibly tough pill to swallow, and dealing with these matters is often the last thing on many people’s minds. Honestly, structuring your estate plan to avoid probate as best as possible should be the focus for your beneficiaries.

Lesson 2: You Have to Think Beyond One Generation

Just like when it comes to investing, knowing the future is incredibly hard (if not impossible).

Whitney was only 41, while her daughter was only seven years old when she last amended her Will. And I’m sure she had the highest hopes but never truly knew what the future had in store for her daughter, let alone if grandchildren were in the cards.

Now, Whitney’s attorney did a good job of accounting for a contingency plan. If the assets couldn’t go to Bobbi, they would go to her mother, father, and brothers via a trust.

However, reality unfolded twelve years later, with Bobbi Brown being 19 when she began inheriting parts of her mother’s estate.

Given the sheer size of the estate she left behind (the true number is yet to be confirmed), that could have easily compounded over the years and provided support for multiple generations. Provided that it continued to be protected within something like a Dynasty Trust. The main draw to Dynasty trusts is that they are designed to survive and protect a large inheritance for several generations.

On that note, an important consideration when it comes to inheritances and a tremendous feature of a Dynasty Trust is asset protection from creditors and problematic spouses.

Bobbi was only 19 at the time of her mother’s death and the designated heiress of a massive estate. If you’re going to leave this much money to a child, it’d be wise to think about the consequences of what that kind of money could do to a child’s life and mindset. She may not have even needed the entire sum, so why not protect it for her next generation?

Lesson 3: You’re Never Too Young or Too Old

In conjunction with lesson two, there’s no age limit when it comes to this kind of planning.

Even the most simple of estate plans.

Petfoodindustry.com claims Millenials and Gen Zers make up almost half of the pet-owning community. Some are creating an estate plan just to ensure someone will care for their fur baby.

Places like Wealth.com, Encorestate.com, and Trust & Will are making estate planning not only accessible but affordable to create valid estate planning documents at home or with your advisor.

Given the notoriety of her mother’s passing, it being public record, and the scope to which Bobbi Kristina was entitled to, the prudent thing for Bobbi’s legal council to do would have been to encourage her to create a Living Trust in her name to further protect her inheritance, and provide some kind of guidance as to what she would like to happen if something happened to her.

We’ll revisit this in the next lesson, but there has yet to be a known record of whether Bobbi Kristina had a Will or Living Trust.

Given the outcome only three years after her mother’s death, even 22-year-old Bobbi’s wishes were never documented, leaving the fate of her mother’s estate in limbo and the beneficiary of a lengthy court battle.

Lesson 4: Update Your Documents!

I understand cost is always a factor, but estate planning is not a one-and-done situation.

Whitney’s last Will was updated in 2005 in New Jersey, although she passed away in Beverly Hills, CA.

One of the biggest things I noticed when going through the document was that her ex-husband, Bobby Brown, was still listed as a potential beneficiary in her most updated Will.

Whitney divorced Bobby Brown in 2007.

She also listed him as the guardian of any minor children. Fortunately, Bobbi Kristina was no longer a minor at the time, but given their history and later divorce, she may have decided to go another direction.

“Houston and Brown divorced in 2007, but Houston did not update her will after their marriage ended. Because of the divorce, Bobby Brown is probably not entitled to any portion of Houston’s estate, but he may be entitled to the portion of Bobbi Kristina’s inheritance that she had received before her death,” attorney office Solomon, Steiner & Peck chimes in.

As I said before, we don’t know whether Bobbi Kristina had a Will, Living Trust, or not.

Georgia intestacy law—where she was buried—states that if you’re single, with no living children, then it reverses back to your parents, i.e. her father. It’s not my place to say whether he is or is not entitled to his daughter’s legacy; however, it is something to be aware of.

It’s all a reminder to update your estate planning documents after major life changes and to include the people you love in these conversations to ensure everyone’s intentions are put on the table.

There are several details of Whitney’s passing that I purposely left out. Nonetheless, it’s clear that Whitney Houston and her only child left us too soon.

It’s fair to assume that someone of this stardom would have these things well buttoned up. But that’s not always the case.

I share this cautionary tale not to scare you from the legacy planning process but rather to inspire you. Understanding some of the complexities that come with these nuanced and complex documents is essential. And ensuring that it will be executed the way you want is even more crucial.

We do all this—spending time, money, and energy—for the people we love and care about to help make their life just a little easier.

If you’re ready to have the conversation but need help knowing where to start, you know where to find us.

*Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their financial advisor and attorney to obtain advice with respect to any particular financial or legal matter.