Our perception of what’s real or not is a funny yet beautiful thing.

It influences so much of what we think and will eventually do next. Take this story of two friends, for example.

In the heart of ancient Rome, two friends, Marcus and Lucius, stood at the market square, gazing up at the imposing Colosseum.

Marcus, who would probably take ice baths and drink creatine today, was once a gladiator and saw the grand structure as a symbol of power and glory. A place where his skills were tested for the masses’ entertainment. Lucius, a dreamer and an artist, perceived it as a canvas of history, each stone telling a story of conquests and the blood shed from husbands, brothers, and sons who never returned home.

They marveled at the same tower, yet their perspectives couldn’t be more foreign to each other. Neither point of view right or wrong—only a reflection of how they see the world. Of course, we know that eventually, the Roman Empire crumbled, and the Colosseum fell into ruin. Still, the echoes of Marcus and Lucius’s differing views resonated through time.

The takeaway is that the lens through which we perceive events shapes our understanding of our environment.

In the same light, take the incessant commentary of economic data we receive on a daily. We all absorb these economic indicators and market fluctuations through numerous perspectives.

Some see opportunities for growth, like Marcus envisioning glory, while others, like Lucius, see a canvas waiting to be spattered with risks and uncertainties. No one can truly say who is right or wrong until reality unfolds and your balance sheet reflects your preordained call. Although, that can be an expensive game to play over time.

This was a great listener question on our weekly YouTube show, “Ask the Compound,” a few weeks ago. He asks about our framework for thinking through the probabilities of a hard or soft landing given this confusing state of the economy.

And I agree. It is hard to get an accurate read on where our economy stands due to the endless play-by-play analysis you get from every piece of economic information that comes out.

Well, where we fare really depends on how you want to look at it. Barry’s initial response was spot on when he reminded us there are two sides to every trade.

Even before you get to the stage of making a statement with your money, depending on what you’re seeing with your own eyes and where you get your information, it has such an effect on what you will believe.

Of course, you shouldn’t only read/watch/listen to sentiments that reaffirm what you already believe. Even perma-bears that you disagree with on virtually everything has some merit to what they’re saying. It’s healthy, at least, to acknowledge the other side’s take on the matter. In fact, risk and volatility in the market exist on the fact that they could be right, too.

Despite interest rates revisiting levels not seen in over a decade, all things considered, they haven’t been unduly restrictive (yet). Sam Ro shows us businesses and consumers are holding up just fine. Moreover, if you have a heavy allocation to fixed incomes, the future looks a little brighter now that rates are off the floor.

Naturally, headwinds still remain for housing after the swift jab and hook shot it took. The data, though, still says real estate accounts for the majority of American’s net worth and has been one of the best creators of wealth. I simply cannot imagine it will be out of season for long.

So, where you see consumer spending going from here with student loans coming back, or the future of the financial sector with the current state of office real estate, or our future global dominance with a bickering government depends on how you believe the next 5, 10, or even 20 years will play out.

Now, when it comes to making that bet with our money is where investors can go wrong.

Drastically adjusting your allocation to sandbag the windows and outsmart the storm that may or may not happen most times just results in someone else getting richer off your dime.

I believe a healthy separation of church and state is good for most investors. Long-term money should be treated like long-term money and short-term money in its own right. Goals, like retirement, the kid’s education, or the ridiculously expensive house, should have an allocation that will account for a range of outcomes, from trends and fads to booms and busts. And if you feel so strongly about a particular forecast you’re making, size it appropriately. Because, trust me, the feeling of being wrong hurts much more than the joy of being able to say I told you so.

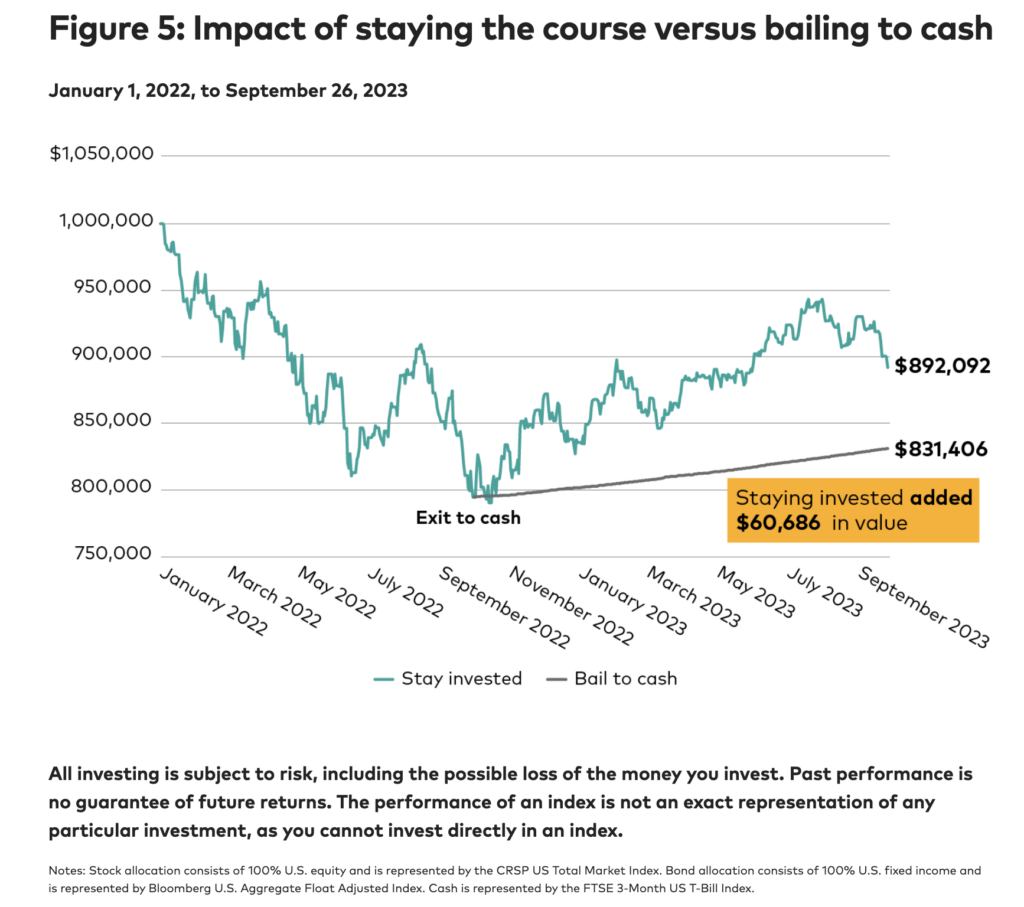

Just consider this chart from Vanguard, showing what would have happened if you bailed on a 60/40 portfolio to T-Bills in the heat of 2022’s bear market.

(Source: Vanguard Investment Advisory Research Center Q3 2023)

Sticking with your 60/40 portfolio despite a nine-month loss of 21% and avoiding a shift to money markets—which were yielding over 3%—would result in a $60,000 difference. And this is just in a year’s time. Over a longer stretch, this could account for years of retirement spending.

As Morgan Housel wrote back in 2016, it’s best to hold expectations, not forecasts. Housel states,

“The important difference between an expectation and a forecast is the impact it has on behavior. If I expect recessions and bear markets, I won’t be surprised when they come. I know they’re a normal part of the game. But since I’m not sure when they will come, I won’t attempt to do much about it. Attempting to do something about it – trading, timing, buying, and selling – is the root of most investors’ misery and mistake in the first place.”

We’re going over a year since the calls for a US recession first began. 99% of the time, economists can’t tell whether we’re in a recession at the moment or not. Only time and the data will tell afterward.

As Barry says in the video, if they couldn’t call it during 2008, what makes you think we can correctly identify what this contradicting mix of data is now?

Your perspective on declining inflation reports, unemployment data, pauses and hikes in rates, and treasury yield fluctuations will better guide your investing path than the data will itself.

I recommend investing with a healthy dose of optimism that we have, are, and will solve many of the scary concerns that we face today. With a dose of realism that markets react to good and bad news, but the unforeseen is what really disrupts it.

So, if you’re anxious about where the economy stands today, ask yourself, do you resonate more with Marcus or Lucius’s perspective on the Colosseum we all stand before?