You know that old saying, comparison is the thief of joy?

Cliche and worn out, yes, but it’s one of those timeless pearls of wisdom that will always ring true.

I’m 25, and I’m starting to feel like I have nothing to show for it.

My Instagram isn’t perfectly aligned with food porn or my latest international destinations.

It’s so damn hard not to look around and feel like each step you take, the world takes two steps further. But the problem with this type of overthinking is that our feeling of inadequacy spills into our conscious and subconscious decisions.

Considering my circumstances, I’m doing OK in life. All my basic needs are met. Yet, why do I feel as if I haven’t really accomplished anything yet?

Truly, I believe it’s from the constant ads or always seeing our social media competition, we constantly put ourselves under pressure to be the next iteration of ourselves—or a carbon copy of the ones we compare ourselves to.

Comparing ourselves to our neighbors or friends causes us to spend hundreds, if not thousands, of dollars more than we otherwise would have.

For instance, Credit Karma did a study in 2019 that revealed that 48% of millennials went into debt just to keep up with their friends. Almost half of them confessed it was FOMO on a once-in-lifetime experience—trips, food, clothes, concerts, tattoos. And this was before inflation really began to ramp up.

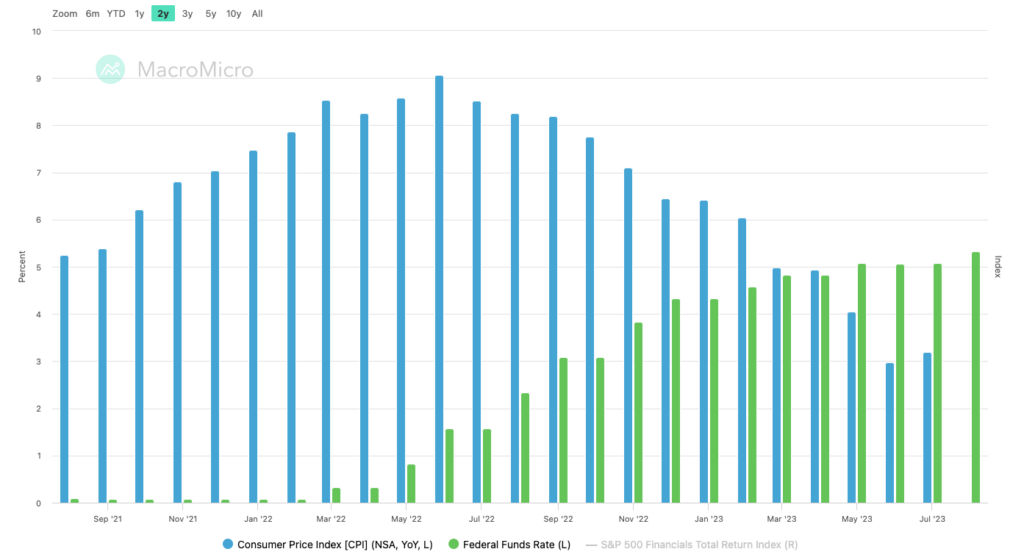

Although the pace of inflation has been declining for the last year since its peak last June, these higher costs just to survive affect everyone.

Last quarter, new data from the Federal Reserve Bank of New York shows that we just crossed $1 trillion in credit card debt. Meaning, many more Americans are extending themselves beyond what their savings and paychecks bring in.

We’re looking at the cosmic swirl of high inflation and even higher interest rates. This could be the start of the pullback in consumer demand everyone has been calling on for months now.

Still, whether or not you believe the Fed was behind the curve when it came to stepping in, it’s clear the last dozen or so rate hikes seem to be working. The latest CPI print came in at just 1% higher than their 2% target, and we could be actively living through the once thought-to-be impossible soft landing.

Fed Funds vs. CPI – MacroMicro.me

For some of you, it may have slowed you down from your goals. Big or small. From buying your first house to putting away money for a rainy day.

But personally, I find comfort in this tweet (X’d?) from Hal Elrod that says,

Remember that you are always exactly where you need to be, experiencing what you need to experience so that you can learn what you must learn in order to become the person you need to be to create everything you want for your life. Always.

— HalElrod (@HalElrod) October 27, 2019

It may help to know that you are not alone. I not only hear, but see that many other people are in a very similar situation, and the point of the Fed’s actions was to do just that: slow our rapid growth down.

So maybe it just wasn’t in the cards for you. Maybe you missed the boat on locking in the low-rate mortgage. But you shouldn’t compare yourself to those who just happened to be in the right position at the right time to make a move.

And if you ignored the misleading headlines and clickbait, you’d realize there are some pretty good concessions, too. Idle cash could be earning almost 5%. The S&P and Nasdaq are up 17% and 38%, respectively, despite last year’s Armageddon. And it’s likely that the Fed is closer to the end of these hikes rather than pushing them any further.

We all have goals and dreams and would like to see ourselves beyond where we are today. And we should.

It’s what drives us and keeps us accountable for what we said we would or would not do. When we’re doing the right things—saving when we can, doing one more rep, reading one more chapter—inch by inch, we get closer to those goals and dreams.

And that kind of progress doesn’t happen overnight.

It’s ok if you haven’t traveled to your new favorite place or made the memories that you’ll spend a lifetime talking about yet. You still have so much time—our best days are ahead of us.

But at the end of the day, it’s the end of summer. A perfect 80 degrees and sunny in New York, and what looks to be the start of a new bull market is in full effect. And we know how fast the morning air can go from muggy and unbearable to cool and crisp.

Unplug. Unwind. And try to appreciate where you are in this moment because, despite all that’s going on, I am certain you are exactly where you need to be.