We haven’t had any substantial bad news since the Chinese “spy” balloon was shot down over US waters in February.

Only to hear days later, another unidentified object was shot down over Alaskan waters. Still, this pales in comparison to the sheer amount of deaths due to gun violence reported in February and March this year, the wildfires in Maui, or the worst tropical storm to hit southern California in 80 years. And whether you love him or hate him, I guess the recent news about our former President isn’t very good either.

Nonetheless, I knew there was going to be a little bit of an overreaction from the market.

The impetus for the most recent volatility?

For the second time in history, the U.S. credit was downgraded from a sterling AAA rating to an AA+ by Fitch rating agency.

Fitch’s rationale states:

“The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

If you’re thinking, wow, that doesn’t sound good at all. You’re right. It doesn’t.

And now, we’ve been put on notice.

This all comes months after the January to March debt ceiling showdown we anxiously watched earlier this year. So now, the House Budget Committee says this is a formal wake-up call to get the fiscal house in order. Otherwise, the consequences aren’t just another credit downgrade but seriously jeopardizing the dollar as a world reserve currency.

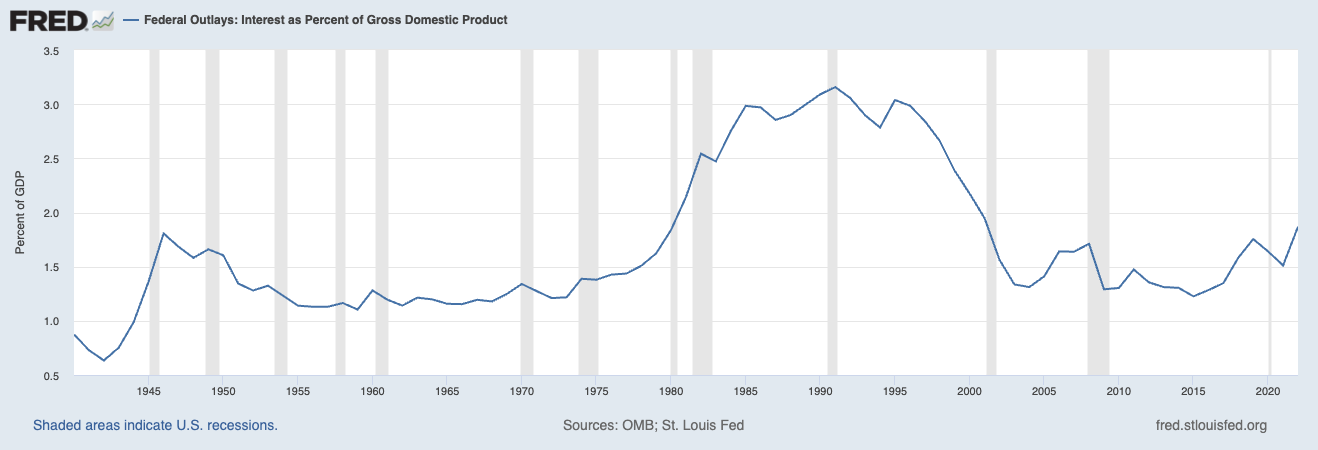

To tack on to that, it doesn’t help that we’re facing the highest federal interest payments ever. Albeit, when discounting the growth in the economy, it’s not as bad as the early ‘90s when our nation’s debt costs were more than 3% of GDP. But we’ve already established that this pace is unsustainable.

Still, the consensus I’m seeing is that the downgrade has more to do with our nation’s medium to long-term outlook rather than in the near term.

Yet, when you combine the recent volatility with the fact that the yield curve is still inverted, it is the short-term that seems to be the most concerning. Let’s look at the facts.

The Facts

We all know that the Fed basically took rates vertical in no time at all. Including six hikes above 50bps.

Today, we’re right at their target of 5.25 – 5.50%. But that doesn’t necessarily mean we’re in the clear for a dovish pivot just yet. Despite headline inflation being closer and closer to the Fed’s 2% target, certain areas of the economy are still well beyond that.

Experts are saying that the risks of doing too little are more detrimental than the risks of doing too much right now.

This was a big point of discussion following the Great Recession—that we should’ve done MORE stimulus to speed up the recovery, but we undershot it. Conversely, it seems like we overshot it with Covid, given the preceding whipsaw effects and stock valuation decline we saw last year.

The silver lining is nearly all of the calls for a ‘23 recession are off the table.

Rates are already high, and the Fed doesn’t need to raise rates further on the basis that our credit was downgraded by a private rating agency.

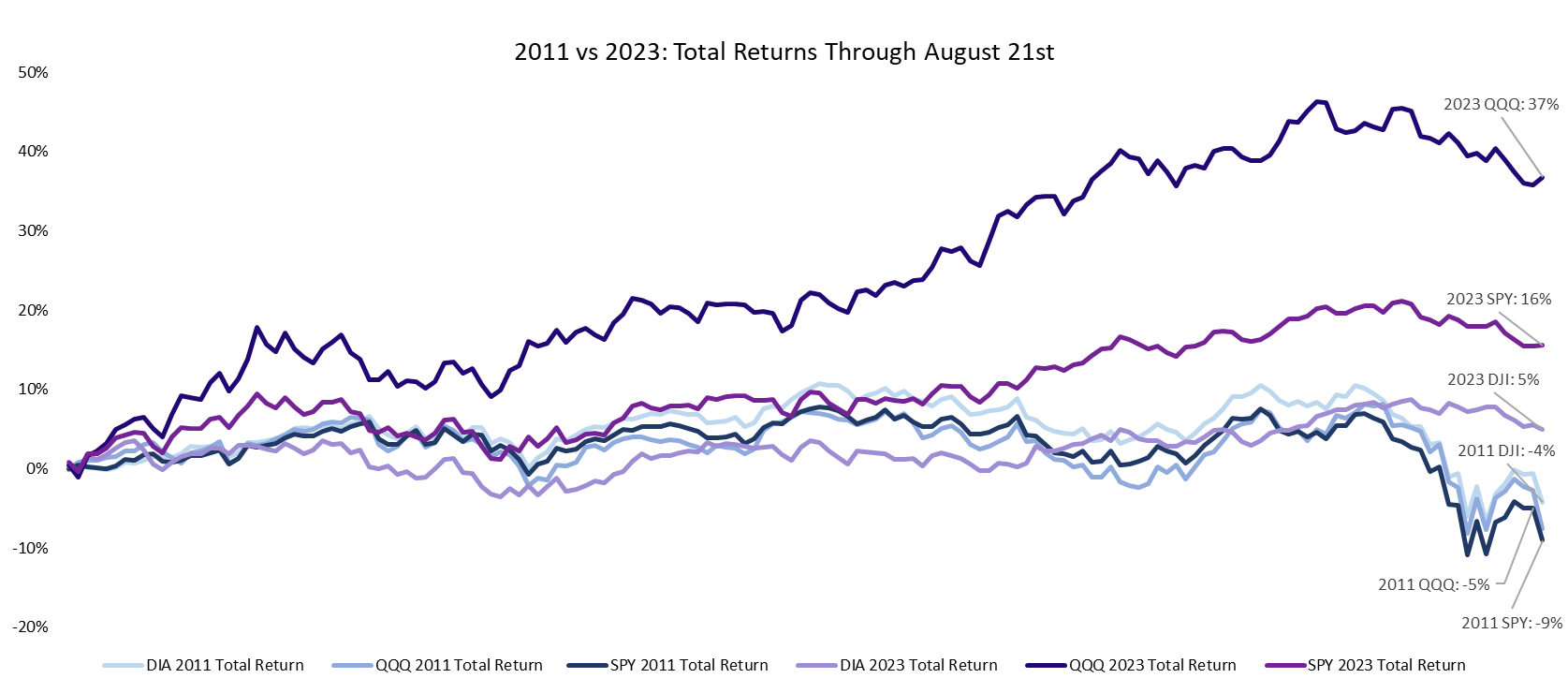

And remember, this is the second time this happened. In 2011, S&P downgraded the US creditworthiness from AAA to AA+. Coincidentally happening around this same time. We can see the initial reaction below—which (understandably) wasn’t very good.

The indices took a much steeper decline, 14-16% when the news broke. It petered out and remained pretty volatile for the remainder of the year.

However, I’m not so sure we’ll see that same fate for the remainder of this year.

Sam Ro tells us, “Today, we have the benefit of having gone through this experience before. And based on the subdued market reactions immediately following the news, traders and investors seem largely unfazed.”

It may provide some reassurance to know that regular people like you and I won’t be affected by this. At least not today.

What about globally or institutionally?

No portfolio managers whose mandate is only to hold the highest creditworthy assets will be forced to sell U.S. treasuries. “Because Treasury securities are such an important asset class, most investment mandates and regulatory regimes refer to them specifically, rather than AAA-rated government debt,” a Goldman Sachs analyst says.

To wrap things up, even though the credit downgrade and the current economic situation might make us wonder, looking at past experiences and what the experts are saying, it seems like we’re handling it pretty well.

The way we and the market seem to be taking it now gives us some comfort that this might not play out like the tough times of the past.

“There are some things people shouldn’t worry about. This is one.” – Warren Buffet

The bottom line is, as of now, this is unlikely to have any impact on the general public.

For those seeking relative safety, there’s no reason not to own Treasuries. Nor have we found a valid reason to begin walking further on the duration tightrope yet. The safest money possible, a 1-month Treasury bill, is paying 5.5%!

In a recent note to clients, Joachim Klement, Head of Strategy, Accounting, and Sustainability at Liberum Capital, wrote: “There’s no alternative to Treasurys in global bond markets.”

In fact, US investors are still piling into short-term assets and money market funds like never before. So despite all this, it hasn’t spooked investors from chasing yields in the slightest.

Still, we all have bigger and better things to worry about. We have no idea what’s next. The future is and has always been uncertain—regardless of whether precedence exists or not.

Whatever issue that’s been posed, we tend to get through it in stride. Too many short-sighted people can only see five feet in front of them. For instance, in an interview with Jamie Dimon, he narrows his eyes to the future. Highlighting technology, AI, and ChatGPT in particular, saying “that will likely help future generations live longer, better lives.” A whole new wave of innovation and challenges we have yet to face before.

Nick Maggiulli wrote a great post yesterday about how being a highly skilled worker will not only put you above your peer group but also protect you from being replaceable by AI and these popular large language model platforms.

What really helped sink all this in for me was what Morgan Housel said in his latest podcast episode. He said,

Take the question, “What caused the 2008 financial crisis?”

Well, to understand the 2008 financial crisis, you have to understand the mortgage market. Then you can ask, “What shaped the mortgage market?” Well, to understand that, you have to understand the 30-year decline in interest rates that preceded it. Well, “what caused the fall in interest rates?” Well, to understand that…

This can go on forever. However, he finishes with this:

People like to say, to know where we’re going, you have to understand where we’ve been. But I think [what’s] more realistic is admitting that if you know where we’ve been, you have no idea where we’re going. Events can compound in unfathomable ways.”

Volatility was to be expected. We’ve seen this before. But there’s no telling if we’ll see another break as we coast only sub-4% and closing in to this year’s all-time highs.

Long-term investors should know that we have to take our random discounts when we can.