A few weeks ago, I was featured in my friend Sam Becker’s piece on the Great Wealth Transfer in Fast Company.

Sam poetically describes it as

“massive, multigenerational avalanche of cash and assets sliding down from the Silent Generation and Boomers to GenX, Millennials, and GenZ.”

This is happening behind closed doors to a myriad of sons and daughters, nieces and nephews, and even individuals outside direct bloodlines.

The truth is, many have no idea what to do or even what to think about this bittersweet plight.

There are so many feelings associated with getting an inheritance. Guilt, gratitude, responsibility, and confusion come to mind. Not to mention, your relationship with that person will certainly affect your decisions.

Losing someone you care about is truly hard. I’ve been through it enough times to know that void never truly gets filled. You just get better at finding ways to memorialize them. Despite the initial relief a financial windfall may provide, there are still underlying challenges such as inflation, debt, or stagnant income, which could mean that sudden wealth merely brings some households back to square one, at best. Regardless of dollar amounts, it’s not as simple as hitting the lottery for some families.

Dealing with inheritance can be an emotional and overwhelming experience, and each person’s approach will differ.

If you’re currently in this position or anticipate being so, I’m here to offer some guidance on how to prepare and minimize any potential feelings of regret or uncertainty

First: Don’t Do Anything

My first suggestion is not to rely on the number you anticipate receiving.

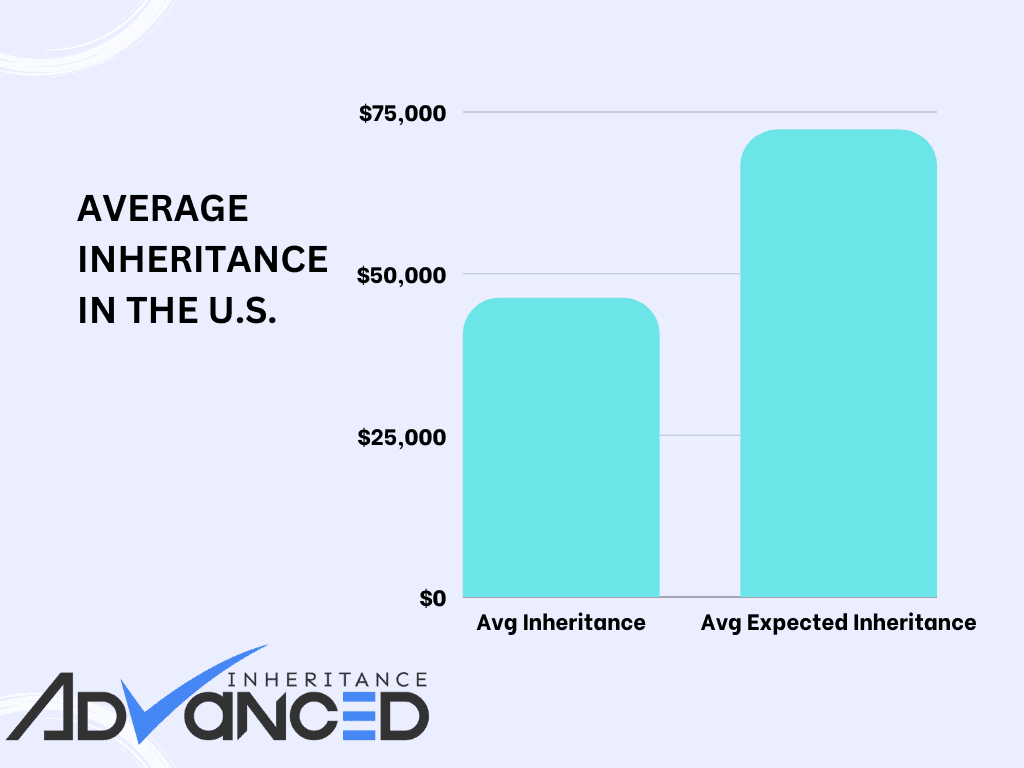

Millennials are set to inherit some $30 trillion in assets from their parents and grandparents. According to the New York Life Wealth Watch Survey, respondents expecting to receive an inheritance anticipate getting nearly three-quarters of a million dollars. However, expectations rarely match reality.

That number is much higher than the average, which the Federal Reserve reports is about $46,200

Without a Trust or direct bequest—which typically avoids probate—you must go through an arduous process of settling the estate. Therefore, you should manage your expectations around the timeframe and actual amount you anticipate. The final amount may be significantly reduced by court fees, attorney fees, and taxes. For instance, you could be subject to your state’s inheritance or estate tax, or both. As you can see, these two numbers could substantially deviate.

And if you’re in charge of overseeing this process, you’re already going through a lot. You don’t have to make any decisions immediately.

Take some time to grieve. You might be thinking about what you wish was different about their final stages of life.

You may ask yourself, do you need long-term care insurance? Should you pay off your mortgage so you don’t have to worry about it in retirement? Should you invest more so you can be financially independent sooner?

Just breathe and take your time. You can decide what you want to do when you’re good and ready.

Next: Think About How It Fits into Your Financial Picture

The next step requires some self-reflection. Consider the opportunities this inheritance will allow. How do you think about this money in relation to the assets you already have?

There are three common ways people plan to spend their inheritance. Paying down debt, supplementing retirement savings, or preserving the legacy with the intention of passing it down.

The next piece of the puzzle really depends on what kind of asset you’re expecting to receive and, ultimately, how that will fit into your financial picture today. The NYL survey notes that 58% expect their inheritance to be in cash, 43% expect it to be in property, and 28% expect it to be in investments.

Here are a few thoughts on how to handle the different asset types.

Inheriting Cash and Investments

It’s unlikely that an inheritance will solely consist of cash but rather of a combination of personal items, cash, stocks and bonds, and maybe real estate.

Cash is simple, and there will be no tax implications when parting with it.

Taxable investment accounts are great to inherit because they allow you to liquidate assets easily and give recipients a step-up in cost basis, limiting your tax exposure if you decide to sell.

Retirement accounts have their own rules, and they could get really confusing really fast. Roth IRAs may offer tax-free withdrawals, but traditional IRAs could be subject to income taxes. Regardless of the retirement plan type, there will likely be a required withdrawal window.

From here, you should determine your priorities and rank them—emergency savings and paying down debt, retirement, giving, honoring this person, whatever it may be—and based on that list, determine how to redirect these funds.

It’s worth working with your tax or financial advisor to implement the best strategy to weave these gifts into your life while supporting your goals and tax situation.

Inheriting a House

Another common situation is inheriting Mom and Dad’s house.

You essentially have three options: you could keep it and live/vacation in it, keep it and rent it out, or sell it. And if it’s split among siblings, it’s best to reach a unanimous decision to avoid conflict.

Depending on your current situation, you may not want or be able to afford to carry those costs of a second home.

Despite what TikTok says about real estate and creating generational wealth, maintaining the grounds, paying property taxes and insurance, and being a landlord is not for everyone. Don’t feel bad if that’s not for you.

Having the Conversation

To avoid family conflict and ensure success can continue to be fostered, the heads of the family must be intentional and deliberate in preparing the family.

I know of many families who feel that they don’t need to talk to their kids about these matters. I can understand keeping money and family separate or a fear of talking about death, but not when your actions can impact someone else so greatly.

Don’t be afraid to be the one to bring these discussions to your family.

If you haven’t already, lean on your advisor. They could be the bridge between generations to help everyone feel at ease and understand their responsibilities.

Assembling a competent team of trusted advisors proves invaluable every time. Beyond handling tax and legal affairs, they can offer wisdom, advice, and unwavering support as you walk through the complexities of emotions and opportunities that lie ahead of your newfound wealth.

I’ve spoken here before about how important estate planning is for every generation. Not just the senior generation.

Conversations about financial planning, wealth transfers, and inheritances shouldn’t be reserved for later stages of life. They should be part of family discussions from an early age.

Along with Bill Perkins and his book Die With Zero, many families would rather see this money put to good use while they’re still around than pass down assets to their already financially stable children.

Either way, life is full of surprises, and it’s best that everyone who should know what to do if, knows what to do if.

The decisions we make today regarding our wealth and its eventual distribution shape not only our legacy but also the financial well-being of our loved ones.