Do you know what the difference between a viagra and a placebo is?

One of them is there for moral support. The other is never going to let you down.

It’s a bad joke, sure, but we’ve always known that what people really want is a short-term solution to make them feel good. I’m sure we all know what the placebo effect is. But if you’re unfamiliar with the concept, the basic idea is feeling that you are better, or getting better, from a remedy or treatment, that does not in fact have any impact on your health for better or for worse. It’s all in your head!

The problem is, it’s a short-term solution to a long-term problem.

This may be why a common theme I see in the investment world is that people crave complexity. Even though “playing dead” or a one-trick pony could do the trick.

But why?

Why aren’t things like less babysitting over your money or knowing exactly who and where it’s going more important to “sophisticated” investors?

From what I understand, people want to feel that what they are doing, or paying someone to do, is more sophisticated than the average schmuck. It’s why some portfolio managers justify you paying more for them to attempt at alpha. But that’s the problem. Most people don’t need complexity. What they really need is a non-emotional, uninterested second/third party to talk them off the ledge every now and then.

Do you know about the placeboes 1993, Macaulay Culkin, crazy cousin, the nocebo effect?

In other words, the nocebo effect says, still given the placebo, you were told terrible things would happen. And because of that, your emotions and even physiology would negatively react to this premonition.

Here are a few examples of how these two self-inflictions, the desire for complexity and short-term thinking, end up in people’s financial lives.

Financial Placebos and Nocebos Today

Everything Is A Narrative

You don’t realize you live in a bubble until you speak without context to someone way outside that bubble and they have no idea what you’re talking about.

The first example of a nocebo is frequently listening to negative news. It seeps into our minds and most times it’s in search to confirm what we’re already afraid of, which leads to poor investor behavior, Carolyn Gowen tells us. I’m not going to even dive into confirmation bias, but the problem with listening to financial pundits and their forecasts, expectations, predictions, etc. is that it will lead you to act upon them.

Sure, it scares you, but deep down, for some reason, it feels right. Because this is it. This is the moment you’ve been waiting for. You knew things were too good to be true. But here’s why you shouldn’t.

Everything is a narrative. All the data, the stats, the charts, etc. are all regurgitated back to us as a story. A story for people to digest. I’m no data scientist (and the data scientist I know would say, “I’m no rocket scientist”) but as we know there are always two sides to every story.

How bad Omnicron and the speed to recovery is going to be, whether the Metaverse is going to replace the internet, or an Italian man trying to dodge the vaccine by wearing a fake arm, are just examples of how the great internet has made it that we all live in our own comfortable bubbles.

Italian man tries to dodge Covid vaccine wearing fake arm https://t.co/zwRZMKVOCm

— The Guardian (@guardian) December 3, 2021

And if you don’t believe that this influences how you see or think about the world and the actions you take, think again.

Inflation: The Self-Fulfilling Prophecy

An example of a nocebo in someone’s personal life may be self-sabotage. We feel as if we are unworthy so we don’t even take the time to do the steps necessary for success. Or, we hate failure so much that we plan on the outcome going unsuccessful to shield our hopes. We can almost manifest these things into existence.

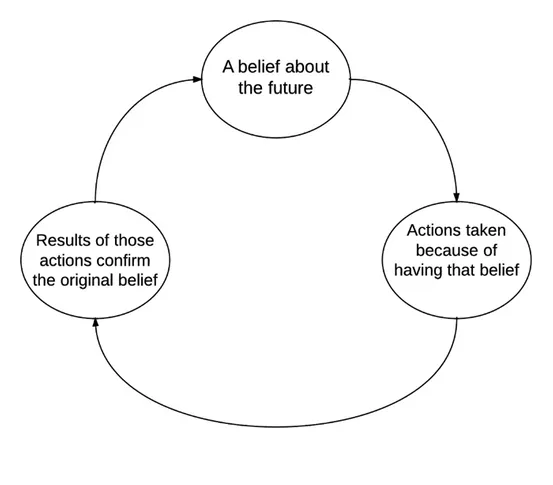

A more famous financial example of a nocebo is the idea of inflationary psychology.

The premise of this idea is that inflation is a self-fulfilling prophecy, in that because we believe or feel prices will continue to rise, we need to raise wages to remain sustainable. For example, wage-earners need to fight for pay increases to deal with increases in the cost of living, price hikes, and the eventual reduction of purchasing power. In turn, we need to raise prices in order to afford to pay these people.

Something similar could be said about the housing market. If everyone is buying homes today and prices will only get higher, I should buy today as well to beat the rush.

Most times, these cause-and-effect relationships keep the inflation rate at a steady beat, when coupled with the Fed’s monetary policy. Although, it can get out of hand, and then it’s known as a “problem.” I’m not saying high inflation can be subdued by ignoring it. And you may not like this example if you believe the President controls things like wages and gas prices, but inflation can be another example of “I think, therefore I am.”

These ideas eventually move to the stock market, which we know moves in cycles. Investors want to outpace inflation, but believe there are risks present, so they price that into their buys and sells.

All valuations are a number from today multiplied by a story about tomorrow. When interest rates are zero the story part is way more influential and this is 100% true: https://t.co/vnNBJ3LcIt

— Morgan Housel (@morganhousel) August 24, 2021

The Sidecar Account

This is my favorite placebo.

We have a lot of clients who have a natural interest in financial markets and their own personal finances. As they should.

Some of them even come from a finance background. And a good number of them have been handling their own money for a long time before they decided to hand over the reins.

For these reasons, we don’t force clients to give us every last dollar. We want our clients to feel that they can feel free to express their investing ideas in whatever fashion they would like. Whether it’s buying call or put options, buying Pfizer over Moderna, or having a ‘Josh Brown’ portfolio, I’ve heard it all. Let’s call it the sidecar account. As long as it helps you stick with your overall allocation, no harm, no foul.

With that, a countless number of people left their advisors in 2008 or 2020 because there was zero communication. In the heat of the days where everything is red, the last thing you want to do is pick up the phone, call your financial advisor, and constantly get the voicemail.

We just want to know the all-knowing question, is everything going to be ok?

They essentially left because they felt as if doing nothing was worse than not even an acknowledgment that the world seemed to be crumbling around them. We have what’s called action bias. Which is the tendency to favor action over inaction. We believe that doing something is better than doing nothing.

If this is you, then listen – take a small percentage of your overall portfolio and go buck wild. Use that small portion to watch the market and make frequent trades while the rest of your allocation powers through the ocean. Undisturbed by the small changes in the currents, waves, and emotional decisions along the journey.

Stuffing Smoke in Your Pockets

The best placebo is the one that makes you feel good about what you’re doing, without affecting your overall trajectory.

Complexity doesn’t always make things better. Not all speculative activities and “investments” are going to move the needle of your net worth, add to your bottom line, or improve performance.

This is not all to say that staying stagnant or not having a robust, malleable, plan is always the clear winner. Some placebos could have a tangible benefit to your bottom line, not just an emotional one, like our structured notes investment solution. But is this just portfolio viagra? A short-term solution to a deeper problem. Maybe.

But, as Glasser and Railey, of Fritz Glasser Capital, advise, “When you’re considering a more complex investment, you should ask, “Can this be done simpler?” Very often, it can — and with lower fees.”

The last I’ll leave you with is from the old book, The Art of War

“If you know the enemy and know yourself, you need not fear the result of a hundred battles.

If you know yourself but not the enemy, for every victory gained you will also suffer a defeat.

If you know neither the enemy nor yourself, you will succumb in every battle.” – Sun Tsu