I’m going to cut to the chase.

In my quest to bring more awareness to legacy planning to Gen Zers and Millenials, I’ve written about two notable cases of extreme wealth, notoriety, and a lack of a solid estate plan—here and here.

Today, I’ll showcase another interesting story circulating in the estate planning world regarding the Queen of Soul, aka Aretha Franklin.

The once teenage phenom signed as a recording artist with Columbia Records at 18 and later to Atlantic Records. Selling over 75 million records across the globe, winning 18 Grammys and a Presidential Medal of Freedom.

That is, before she passed away in 2018 from pancreatic cancer at the age of 76. Leaving her final wishes to the interpretation of messy handwriting and a court battle that almost tore her family apart.

The woman who once commanded a little r-e-s-p-e-c-t was known to be a private person and sought to keep her private life, well, private.

First off, if that was her goal, her original plan didn’t do a great job of accomplishing that.

In 2010, Aretha handwrote her own Will. Leaving her four sons to share the income from her music and copyrights equally. Where understandably, she originally required her boys to obtain a college degree and take a business class if they wanted to benefit from the money she planned to leave them.

A handwritten document as a means to outline your final wishes is known as a Holographic (not the same thing 2Pac showed up on at Coachella) Will, which is only valid in some states. Only 28 states accept a Holographic Will as a valid document. One of which is Michigan, where Aretha resided when she passed on.

Despite drafting her own Will in 2010, that’s not where the story gets interesting.

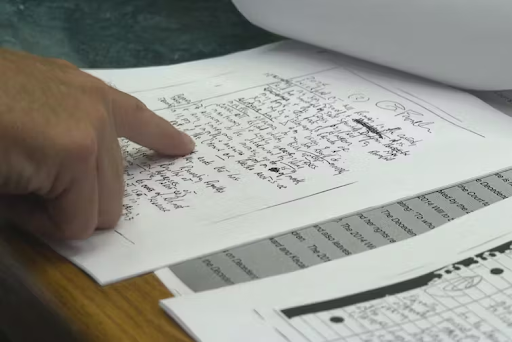

There was a second set of notes Aretha wrote and signed (to amend or replace her previous Will?) in 2014. What was even more fascinating was where these notes were found… between her couch cushions!

Her niece was rummaging through Aretha’s house when she found the second set of notes which appeared to be her aunt’s scribble.

As we learned before, a Will is still a public document that requires you to go through a probate court in your state.

More than that, in Aretha’s case, her Holographic Will ultimately required a jury to settle the confusion and disputes between the two documents and three of her four sons. Requiring each of them to obtain their own attorney to fight for their case.

Aretha’s oldest son, Clarence, lives in an assisted living facility with special needs. I’m sure she would have made it very clear that she wanted to set something aside, particularly for Clarence.

Fortunately, Betsy Reed at The Guardian writes: “His guardian’s lawyer told the BBC that they “have reached a settlement that gives Clarence a percentage of the estate without regard to the outcome of the Will contest.”

Franklin’s estate was worth nearly $80M when she died. However, after bills, millions in estate taxes, and repulsive court and legal fees, roughly $6M was left after the detritus of it all. To repeat that, 92.5% of her net worth was vaporized by these costs from 2018 to the time it reached her children this year, in 2023, due to a lack of proper planning.

Now, I can understand her desire to keep her personal life confidential. We all understand the pressure and close eye the press can keep on famous people. Countless celebrities commented how they would give up their fame just to walk through a grocery store undisturbed again. However, Aretha seemed to be on another level.

Don Wilson, her entertainment attorney for 30 years, attested that she was a private person and didn’t care to share these kinds of details with virtually anyone—even an attorney. Still, after a few initial discovery meetings and finalizing her wishes, a Revocable Living Trust—which provides a ton of privacy by avoiding probate—could have saved her family a ton of heartache. And subsequent planning could have avoided the millions of dollars her estate paid in taxes and court fees.

Not to mention how easy it is to amend this document. The word revocable is in the name. And to take this further, typically, the first page of these documents has a clause to revoke any existing documents.

As life goes on and your children’s personality traits become more apparent, it’s perfectly fine to change your mind. To give more or less. Or put certain protections around their share. Or honestly to protect them from themselves.

This would have been helpful to know if she still required the boys to get a degree or certificate to receive their share of the inheritance. And it could have provided the clarity her sons needed whether the 2014 Will was an addition or scrapped the 2010 Will all together.

Ultimately, the jury on the trial determined the 2014 Will to be the most recent and valid Will.

Nonetheless, hindsight is 20/20.

We can easily play armchair quarterback with Aretha, Whitney Houston, and even Amy Winehouse’s situation. But the reality is, if they were properly constructed, we would never know about them.

You might think writing down your dying wishes with a pen and pad is much easier and cheaper than going through the formal process of getting your estate planning done before putting your life back on autopilot.

But a Holographic Will can be subject to many issues and much, much more expensive on the back end. Inadvertently only complicating your heir’s lives and substantially reducing what you originally intended to leave behind for them.

Again, we invest time, money, and energy to make the lives of our loved ones easier and more comfortable, to show them how much we care.

The next time you find yourself in a heavy conversation like this, and the thoughts begin to swirl in your head, don’t just grab a pen and a napkin. Give us a call.

*Disclaimer: The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact their financial advisor and attorney to obtain advice with respect to any particular financial or legal matter.