Why are we so pressed to see rates come down?

I would argue that most people would be in a much better financial position with rates off the floor.

So far, the economy has shown that these higher rates aren’t so restrictive that we can’t ease inflation without breaking too many things. Not to mention, the stock market is an expectation and discounting machine, likely pricing in all sorts of rate direction scenarios.

I feel we’ve gotten so punchdrunk in love with ZIRP, cheap money, and risk-free bets in the market that we didn’t realize it was all a mirage. Which dates back almost 15 years to the emergency stimulus measures we put in place after the financial crisis and just left them there.

At peak craziness, it got so easy you could buy a monkey with a green background and retire early.

Looking back, 2022 was the snap back to reality that we needed.

It reminds me of when I read Howard Marks say, “Capitalism without bankruptcy is like Catholicism without hell… Markets work best when participants have a healthy fear of loss.”

We went from TINA to owning risky assets to TARA—“There Are Reasonable Alternatives.” And that’s a good thing.

Most consumers have been better off with rates in the 5.25-5.5% range. So, do we really need rate cuts to feel like we can make financial progress again?

Are cuts going to help the stock market?

In theory, lower interest rates should make borrowing easier and less expensive to fund operations. Eventually boosting earnings and profits and relieving pressure on future growth rates.

That has not been the case in the market for two years now. I asked Ben Carlson about the same question, and the first thing he noted was the recency bias going on.

“I think there are still a lot of people who assume the only reason stocks went up in the 2010s is because the Fed cut rates and kept them so low. And [now], a lot of people assumed the only reason stocks have kept going up this year is because they assumed the Fed was going to cut rates. [Well] last year proved the stock market can continue rising when rates are rising as long as corporations are still increasing earnings.”

In fact, the first quarter for the US markets was phenomenal. The S&P crossed the 5,000 mark in early February, posting its first all-time highs in two years.

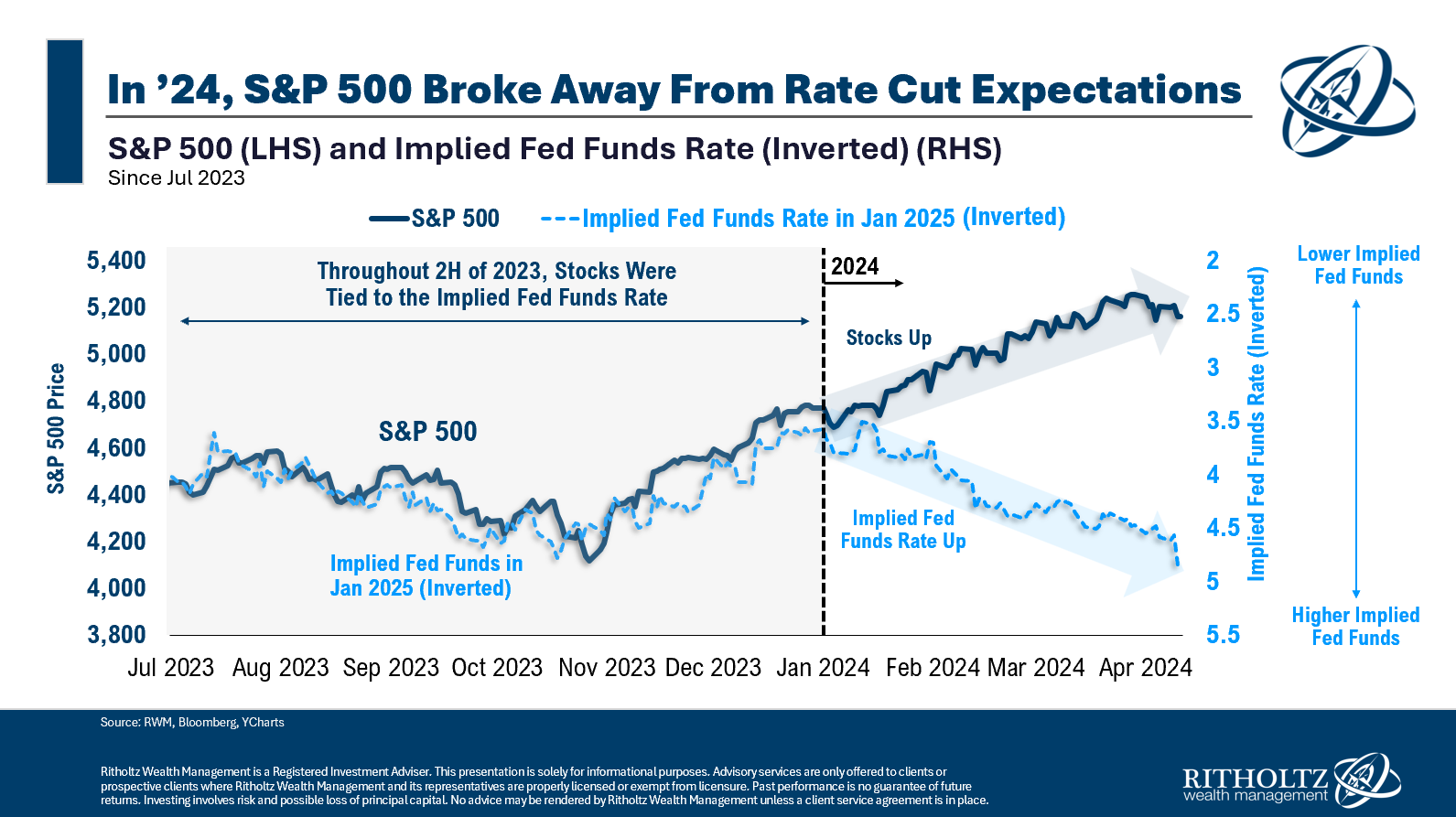

To Ben’s point, the Fed did suggest that we could expect as many as three cuts this year. Many traders and institutional investors were likely pricing this in in anticipation of the cuts.

Up until this year, the market’s path was highly correlated with rate cuts certainly happening. Then something shifted. Even though the interest rate futures market—the light blue dotted line—now took those bets off the table, the market continued to increase. Companies are still finding ways to make money despite the new reality that cuts might not be coming so soon.

If you peek under the hood of this first quarter, you will see that consumers are still spending like their lives depend on it, and corporate profits are reaching all-time highs.

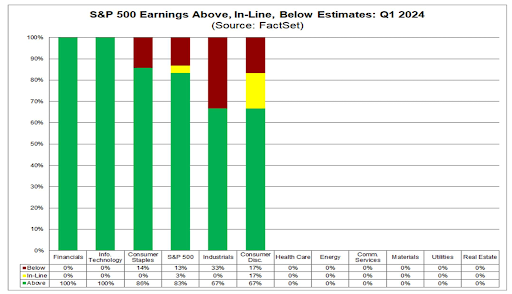

According to FactSet’s latest earnings scorecard, of the companies that have reported, there have been, in some cases, 100% more beats than misses.

Now, if the AI hype is real, business productivity and efficiency will continue to improve, provoking or sustaining the growth we’ve already been seeing. (I’m talking to you Nvidia.)

The Housing Mess… I mean Market

The other major assumption is that lower interest rates could jumpstart home sales and help pre-2022 homebuyers feel less like they’re boxed into their current homes. Still, the bigger issue here is the lack of supply; the foundation holding up home prices.

It was quoted that nearly 40 percent of single-family homes will be owned by institutional investors by 2030. As a want-to-be homeowner someday, I sympathize with all the people who either couldn’t afford the stickier price or got outbid over the last few years. And if you live in a big city like NYC or Chicago, many of us GenZers feel like we’re stuck between a rock and a hard place, with both homeownership and retirement being a mere pipedream. We’ll see if the End Hedge Fund Control of American Homes bill ever gains any traction. But more on this another day.

Even though national home sales and new building permits have dropped precipitously since 2022, this trend seems to have bottomed and even reversed course. Both are slowly ticking higher.

Still, the good news is that if you were set to buy and are still waiting in the bay, you’re actually getting paid a decent rate to sit on the sidelines.

The average high-yield savings rate is paying 4-5%.

Again: TARA. You don’t have to risk that money in the market just to get some yield, and you can keep liquid enough that if/when the right house comes along, you can tell the agent, “Just tell me where I need to wire the money.”

The hope is that you will eventually be able to refinance and reduce your monthly carrying costs to more manageable levels. Mortgage rates ebb and flow, and 6% mortgage rates aren’t as astronomical as you might think.

Are these higher interest rates causing a recession?

Of course, I can’t speak on only the good without talking about the very real risks that are yet to be seen.

Many companies are still evaluating costs, which has led to more layoffs. We’ve started to see an uptick in the number of unemployed people. For instance, the unemployment rate bounced from 3.7% to 3.9% back to 3.8% in the first three months of the year.

And despite the substantial progress we’ve made, inflation is like a cough that just won’t go away. On a year-over-year basis, CPI remained elevated in February and even saw a slight increase in March. This JP Morgan report credits shelter and energy prices as the driving forces behind last month’s countertrend.

The data for the last six months are encouraging; however, as inflation continues to move in the direction we want, there are risks of keeping rates unchanged for too long.

The New York Times Fed reporter, Jeanna Smialek, wrote,

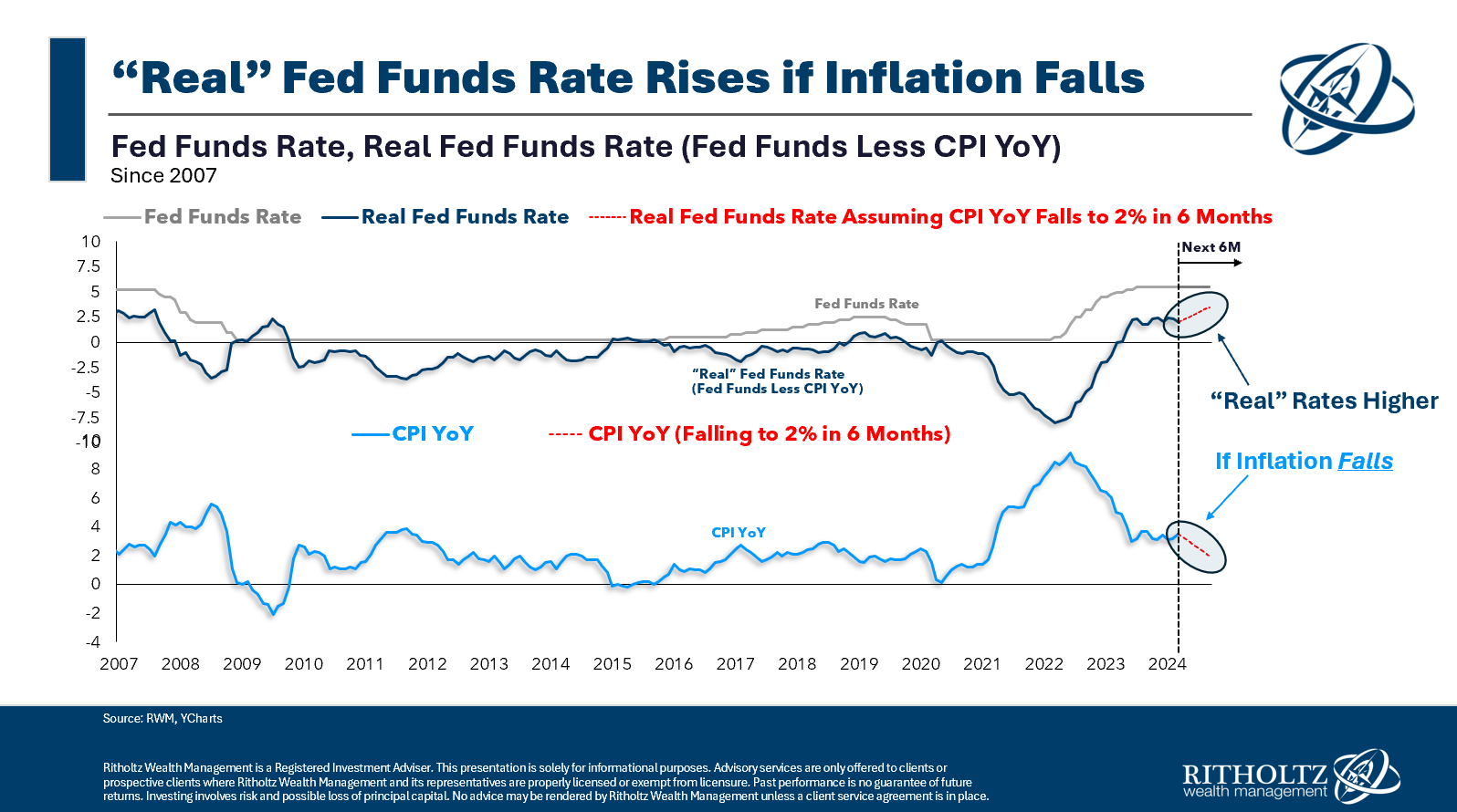

“But many experts think that what really matters for the economy is the level of interest rates after they’re adjusted for inflation. After all, investors and lenders take into account the future purchasing power of the interest that they will earn as they make decisions about whether to help a business expand or whether to give out a loan.

As price pressures cool, those economically relevant real rates rise. For example, if inflation is 4 percent and rates are set to 5.4 percent, the real rates are 1.4 percent. But if inflation falls to 2 percent and rates are set to 5.4 percent, real rates are 3.4 percent.”

It’s like turning off the AC in the summer and letting your home heat up naturally. The chart below shows just that.

As CPI continues to fall closer to the Fed’s 2% target, the rising “real” Fed funds rate (discounting for inflation) will have a much larger effect on the economy. It would affect things like credit expansion, investment in real assets, and GDP growth, which could push us closer to recessionary territory.

Many felt like the Fed should have seen the huge run-up in inflation coming. Therefore, they should and could have started slowing hiking rates before we had a full-blown implosion.

What’s to say they won’t be late to the party again, not cutting rates before fully tipping us into a recession?

Well, Nick Timiraos’ book shed some light on Powell’s approach to rate decisions. Powell’s new approach shifted to “instead of preemptively lifting interest rates to head off higher inflation—the central bank would wait until actual inflation had risen.” This revised stance would ensure that the Fed wouldn’t make tiny little rate moves every time inflation deviated from the script.

No. They would use two of the strongest tools in the shed: monetary policy and information.

It’s like when Ben Bernake said, “Monetary policy is a cooperative game. The whole point is to get financial markets to do some of our work for us.”

So the Fed leaves these breadcrumbs in its speeches before actually making a call. The market digests this information and could react in a myriad of ways. But as long as the economy keeps taking steps in the right direction, the Fed won’t need to cut rates—with a nice 500 basis point cushion to work with if things do get nasty out.

Cleared to land

With all this said, I truly don’t understand why everyone is so focused on when Jay Powell will make cuts.

It’s an incredible balancing act to really land this thing, and honestly, it almost feels like we can see the runway.

The Fed not only needs rates to move rates at the perfect speed but also in the perfect place over time, so if they need to reverse course, they have the room to do so.

Experts have said so many times the real risk we run is cutting rates too soon and sparking inflation again

The central bank governor, Michelle Bowman, spoke to the Shadow Open Market Committee, a group of economists whose objective is to evaluate the Fed’s policy choices and actions—aka watch the Fed’s every move.

Bowman states, “Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2 percent over the longer run.”

I think many would agree that we would much rather have inflation come down and remain stable without tipping into recession than low rates, cash and bonds yielding nothing, and the housing market continuing to price first-time homebuyers out of the market.

Businesses will always find creative ways to make more money, and what they don’t say is that they’re sitting on huge piles of cash and earning the same yield as us. So, If we can continue to make progress in reducing inflation while sustaining employment, these higher rates will benefit most consumers, not burden them.