Congratulations!

If you bought your home before the storm – some of the highest home sale prices since the Great Financial Crisis and now 30-year mortgage rates coming in hot at 5% or more – you’ve seen a nice bump to the value of your house.

Ever since the days of being trapped in our four walls, home renovations have been on many homeowners’ to-do lists. Since then, I’ve been having conversations about the best way to make this possible when inflated pricing on everything else is causing them to reconsider their timeline.

Whether you’re still blessed with remote work or just need a new look, you’re either updating the house to a more modern look or transforming the house so that everyone has at least something to enjoy.

But with inflation still as high as it has been and wage growth not keeping up with inflation, it’s been tough for some to find the funds to pull off a home makeover.

In his case for buying a house right now, Ben Carlson says, “The New York Times calculated Americans have added $6 trillion in housing wealth over the past two years.”

Despite the fact that home values have seen a significant facelift, before you bet the house, consider these options before borrowing on that newfound wealth.

How to do it

If you recently purchased your home within the last two years, you may not have a significant enough amount of equity to borrow against. And, if you spent down your taxable investment account to fund the purchase, you may be back in the rebuilding phase. So, these options may only apply to those who have been in the same home for at least five years or more or have significant investment assets that are still intact.

Whether you’re rich on paper or house rich, the two primary ways to borrow from these sources: HELOCs and SBLOCs.

A HELOC, or Home Equity Line of Credit, is a revolving line of credit (like a credit card) backed by the equity in your home. This means you’re using your home as collateral.

Most people are already pretty familiar with what a HELOC is. However, you may not be as familiar with the other form of financing.

So then, what is an SBLOC?

The acronym stands for Securities Based/Backed Line of Credit. It’s similar to a HELOC, but you use the equity in your taxable investment account as collateral. An SBLOC allows you to tap into the value of your investments without disturbing the coveted compounding effect and create a taxable event.

Why would you do this?

Again, it allows you to borrow from yourself quickly and possibly at a much more favorable interest rate. Secondly, disturbing premature gains could be costly in the long run. And lastly, selling down on your account could create a taxable event, incurring unnecessary capital gains taxes.

However, despite interest rates being lower than, say, a personal loan or certainly a second mortgage, the risks are elevated during a market slump. A portfolio that is not very well diversified could be subject to a severe maintenance call by volatility like we’re seeing today. Even more so, some lenders won’t even offer lending on such a portfolio or will tie it to a much worse interest rate.

When is a good time/bad time to do either?

We can start by comparing interest rates from one year ago to today.

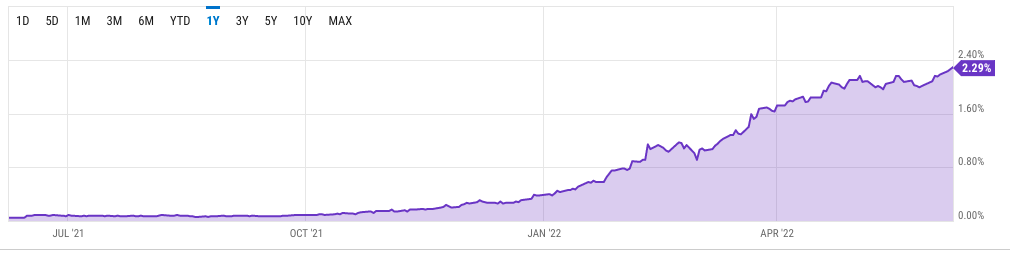

The 1 Year Treasury Rate is at 2.29%, compared to 0.05% last year. Same story for the 10 and 30-year Treasury rates, much higher than last year’s rates by 1.50% and 2.15%, respectively.

In a recent Forbes article released this past May on HELOCs, Andrea Riquier says,

“If you’re interested in tapping home equity, now is the time to do it. The Federal Reserve has signaled that it expects to raise interest rates several times in 2022. This generally causes HELOC rates to move up.”

However, in the case for SBLOCs, the Goldman Sachs Private Bank sector reports that when it comes to home renovation projects, “compared to a HELOC, an SBLOC may be simpler, quicker and less intrusive to arrange, and the interest rate may be lower.”

Although this is true, tax-wise, HELOCs may be more advantageous for capital improvements to the home. Because, when using HELOC funds for these kinds of projects, you are allowed to deduct interest paid so long as you improve the house’s value.

The reality is that most people have more equity in their homes than in their accessible investment accounts. Meaning there’s more available to borrow from, considering most custodians offering SBLOCs will have a maximum 70% cap on how much of the portfolio you can tap into.

Although these two financing methods may allow you to access your illiquid wealth today, another option is making headlines.

Because of the high inflation and the inflated cost of virtually everything making it harder to buy the same goods with the same amount of dollars, consider extending this goal out in your financial plan, saving in I-Bonds. I-Bonds, which tie to inflation, are especially hot right now. For example, married couples could invest up to $10,000 each in their accounts annually, for a total of $20,000. You could then lock in the current inflation rate, yielding 9.62% for the next six months, and wait at least twelve months until you regain access to the funds to make a withdrawal.

Should you do it?

Between 1997 and 2007, the average American saw a nearly 33% increase in their bottom line – partly because the S&P rose by 52% in those ten years, while the average home sale price from 1995 to 2005 increased by more than 78%.

But listen to this: From 2007 to 2010, the median American net worth fell by almost 40%. Which makes sense considering the value of most people’s homes makes up a large majority of their net worth.

Since the trough of 2009, we’ve been given ten years of point-blank easy investment returns. Even after several months since the crash of 2020, the stock market resumed as if it never happened. And in the latter half of this same decade, at any point, you could check Zillow and see your house price alone has increased by 40%.

The problem is that we could be on the cusp of a housing bubble … again.

In theory, house prices react similarly to bonds when interests are on the move. Now that we are in a rising interest rate environment, increasing mortgage rates should help cool housing demand. Secondly, there is a good chance that because many large employers are requiring their employees to return to work on a regular basis, the level of migration from major cities could see a significant shift in velocity. Elon’s letter to employers may be an extreme example, but it’s also not out of the norm.

This means that we could finally see home price growth in major cities’ urban and suburban areas flatline, or at least slow their current growth trajectory.

Bill McBride, who writes a lot on current real estate in his substack CalculatedRisk, says, “During the housing bubble, many homeowners borrowed heavily against their perceived home equity… and this contributed to the subsequent housing bust.” But recently quoted the Freddie Mac website, communicating, “the material decline in purchase activity, combined with the rising supply of homes for sale, will cause a deceleration in price growth to more normal levels, providing some relief for buyers still interested in purchasing a home.”

Although real estate has historically always been a relatively stable asset class, the massive wave of double-digit house appreciation will not last forever.

Fortunately, Bill is not forecasting a “housing burst” or anything like we’ve seen during the GFC, but we very well could see home values cool off in the near future. But what’s more fortunate than this is that we have history and more stringent lending standards on our side this time.