10:46 per mile.

Many people may be able to relate to this: I was never big on running — especially long distances.

The pandemic changed that. I called my apartment the box. And after a few weeks of being bored enough to understand that the walls know everything and becoming overly interested in my neighbors arguing with each other, I had to get out of the box. So, I got up early every morning to walk.

Even as a kid, I used to run around our trailer park version of a cul de sac, three parallel double-wide trailers perhaps 10 yards apart, like a bat out of hell.

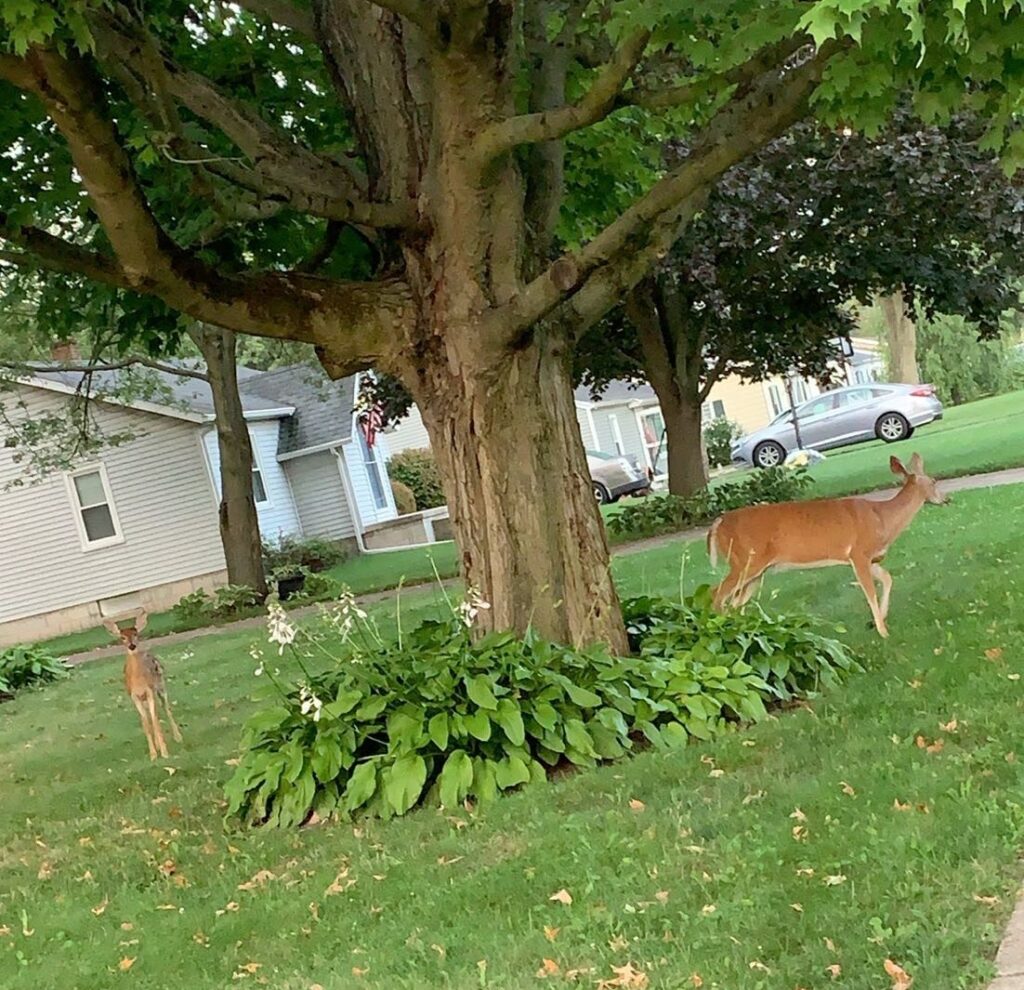

To this day, I still have those same sporadic bursts of energy so naturally, walking wasn’t enough for me. Eventually, that beautiful crisp morning walk, imperfectly scattered with gorgeous Blue Jays jeering, the smell of freshly cut grass, and families of deer, seamlessly transitioned into a three-mile run.

In just a few months, I will run my first organized 10K. Ten minutes and forty-six seconds per mile is the pace I need to beat my personal record.

The agonizing pain of such sore legs makes me question whether it’s worth it. I’ll admit, I skip leg day enough as it is. And it can be challenging to accept at times, but being confined to my bed and sleeping in past 8 AM for multiple days isn’t a loss. Instead, it’s a few days of rest that my muscles are using to grow more resilient for the race.

In my eyes, losses aren’t always a bad thing. Just knowing where the Nasdaq and S&P are today, odds are, you might be sitting on some losses in your portfolio. However, losses are potentially just tax-free gains. So if you’re in a tax bracket of 22% or higher, you should be utilizing tax-loss harvesting to reduce your tax future tax liability.

Many investors suffer from what my colleague Blair coined the “get even-itis.” The feeling that we need to wait for our not-so-hot investment picks to get back to our purchase price before we can sell. Here is how tax-loss harvesting takes advantage of those losses and why you could be using it today to get future tax-free gains down the road.

How TLH Works. How does this help with your tax picture?

The first time I ever heard about tax loss-harvesting, my colleague told me about how, thanks to the pandemic, he and our trading team would be harvesting over $100,000 in losses for one of his clients.

My first two reactions were: well, this guy is an idiot. Why would he be happy his client lost so much money? And secondly, well, this guy is an idiot. You can only deduct up to $3,000 of losses on your taxes.

And then he explained to me how TLH works. Who’s the idiot now, right?

TLH essentially works like this; let’s imagine you have a mildly diversified portfolio of ten stocks. Each position spread across different industries and asset classes.

One of these positions is shares in Robinhood, and you’re sitting on a significant loss. However, by swapping out the losing position in your lineup with a similar investment, say Charles Schwab stock, you can harvest the loss by carrying it forward and using it against the capital gains you’ll realize when you finally withdraw from this portfolio.

For instance, $10,000 in long-term losses netted against $5,000 of realized capital gains equals a tax-free distribution. In addition, you can use up to $3,000 of that loss against your ordinary income (salary income) and carry the $2,000 of losses forward indefinitely.

One thing to note is that this strategy is only applicable to taxable investment accounts because qualified and tax-advantaged accounts grow tax-deferred. So you would only use TLH in accounts like brokerage accounts, some trusts, and even custodial accounts.

It almost sounded too good to be true. So if you’re going to do this on your own, what should you be looking out for?

What are its limitations?

To avoid taxpayers from abusing this freebie, the IRS wouldn’t just give us this loophole without a kicker.

Successfully pulling off TLH is fairly simple using ETFs. You could easily swap a Vanguard small-cap stock ETF for an iShares one. It may even be unintentionally achieved during your annual rebalance. But when using individual positions and doing it without professional help, the trick is to avoid the wash sale rule.

What is the wash sale rule?

This tax rule says that you cannot repurchase the same (or substantially identical) investment 30 days before or after the date of the sale. A classic example would be swapping preferred shares for common stock shares of the same company and vice versa.

Essentially, if done incorrectly, this rule disallows you from deducting the loss. Defeating the purpose of doing it in the first. It’s a little more complicated than that, but here’s a more thorough explanation.

Customize the Regimen

Imagine what would happen to my body if I never took a rest day.

Day in and day out, I trained. Running and lifting weights. By the middle of the next week, I would be exhausted.

There are regimens to soreness and schedules and advice I could follow to get myself in game shape – some of which I will take up. But although I would never consider myself a seasoned runner, I’d like to think I know what I’m doing and how to take care of my own body. I’m using some of these expert-made schedules for newbies, yet building around them to play to my strengths and weaknesses. I’m great at finishing strong, but I find myself exhausted mid-run because I just shoot right out of the gate. Not setting a sustainable pace upfront.

Speaking of customization, if you’re familiar with our firm, then you might be familiar with the concept of direct indexing. This is why I believe direct indexing is going to continue to gain popularity in wealth management. Of course, this will be a conversation for another day, but one of its prime features is working within the index. This allows us to be more tactical. Surgically harvesting individual position losses within the index, without disturbing the rest of the portfolio.

Despite the indexes holding up as expected, individuals are getting creamed. Take Affirm, for instance, a company I thought would be a clear winner.

Unfortunately, I’m still holding on to this in my personal trading account. But I think I’m a bit too late at realizing that the smart play would be to just take the loss in exchange for one of the traditional finance juggernauts like JP Morgan or Bank of America. With all the mortgages and loans these giants have been pumping out, and the ability to set aside such massive cash reserves, they aren’t as reliant on new revenues and will handle high inflation much better. So you can even see here, the trick shouldn’t be to avoid the loss. It’s to capitalize on it.

Out of the Box

I’m sure we all have some residual endeavor or another from the pandemic that, even though it’s (almost) over, we can’t live without it. This is mine. But moreso, I’m just happy to be out of the box. Now as I prepare for the big race, some changes must be made if I’ll have any chance at keeping up with veteran runners.

I’m changing my diet, reminding myself to hydrate more often, and running faster and longer than I’ve grown accustomed to.

Just as I can’t train harder without enduring some growing pains, you most likely won’t make it out of this storm without some losses. Therefore, if you are in a high tax bracket, and this is not standard practice for you, you’ve already lost the race.