After dropping out of college to work at a ski resort, Linda chose adventure over the beaten path.

See, Linda J. Miller was born in 1938. You can do the math, but yes, that makes her 85 years old. And what makes her age so important is that Linda has been skiing since presumably the ‘50s.

At the time, Linda figured she would rather end her days by 2:00, skiing for roughly $2/day. I suppose rather than the monotony traditional education to climbing the corporate ladder may bring. Even today, Linda grabs her poles, shadowy charcoal helmet, and skis and hits even Colorado’s most daunting slopes.

Well, on October 7th, Linda described what every seasoned skier fears the most.

A fall that could keep her permanently off the slopes. And at her age, the probability of that happening could easily triple.

“What is the matter with me? For starters, my internal dialogue is “don’t fall,” “be careful,” and “whatever you do, don’t fall;

My anxiety about falling is based on reality.”

I can’t stress the importance of the strength of your inner dialogue enough. For most of us, it can decide whether you will or will not act. Whether you will or will not attempt that hurdle again.

I remember how terrified I was when I made my first blog post in 2019. To this day, this blanket of anxiety comes from knowing the internet can/will scrutinize your every word. Trust me, give it some time, and it can invade your every thought, too. My colleague Blair DuQuesnay nails all the reasons why we write, but how the second you hit publish, it roars back again.

Whether it’s anxiety over gliding across the icy Colorado mountains, writing, posting pictures on Instagram, or right at home, over the computer screen — we all have an internal dialogue that may be based on real anxieties and fears.

A lot of new and seasoned investors are nervous about wading back into the waters after the stock market takes these big plunges. But that little voice – the inner dialogue – shouldn’t stop us from making crucial wagers for our future.

Follow me here.

Look at the tech bubble. Or ’08, or the aftermath of the pandemic. Our bull runs can be unremitting, yet it feels as if our craters are also as immense.

New York Times’ Nathaniel Popper writes, “trading in the [US] stock market has not only failed to recover since the 2008 financial crisis, [but it has also] continued to fall,” back in 2012.“ Popper says, “even though American stocks have doubled in price in the last three years, investors and traders large and small keep giving the market the cold shoulder.”

Undoubtedly, there will be many investors who are scarred for life after dealing with 2022’s massacre.

Those who decided to run for the exits may still be licking their wounds. (We’ll assume they were purposely trying to do a lot of tax loss harvesting. But) It will be interesting to see if trading volume declines after the wake of last year’s performance.

We’ve certainly seen parallels in the crypto and NFT world during this crypto winter.

Jordan Major, a digital asset buff and editor at Finbold, says, “trading volumes in non-fungible tokens (NFTs), also known as digital art and collectibles … have dropped by 97%.” And that makes sense.

Much of the speculation is off the table. So many of the dollars now are running towards somewhere tangible, with a proven track record. Value investors are finally having their day in the sun. Though only time will tell if the sequel, Rise of the Planet of the BoreApe, ever comes to light …

However, I think this is particularly important because December through February tends to be bonus season for some employees, by and large. For some, the checks may not be as big as last year’s, but still, money is money. That influx of cash could help in a few key places at home.

For starters, you could pay off any lingering high-cost debt. Rebuild the savings. Or, invest in materials for your hobby. But whatever is left over should absolutely get invested back into your future.

“The older you are, the more precautions seem to be in place,” Miller reminds us.

And that’s fair. It seems the older we become, the stronger our internal monologue becomes. Or, maybe, the more pervasive it becomes. This means trying new or even old, daring things become less frequent. Probably because you may not have the time, or in Linda’s case, youthful regenerating capabilities, to recoup what could be lost.

She goes on to add, “The inner dialogue changes—This doesn’t mean I believe I will not fall again; it simply means … [I] am not blocked by anxiety and an inner dialogue that presents the worst-case scenario.”

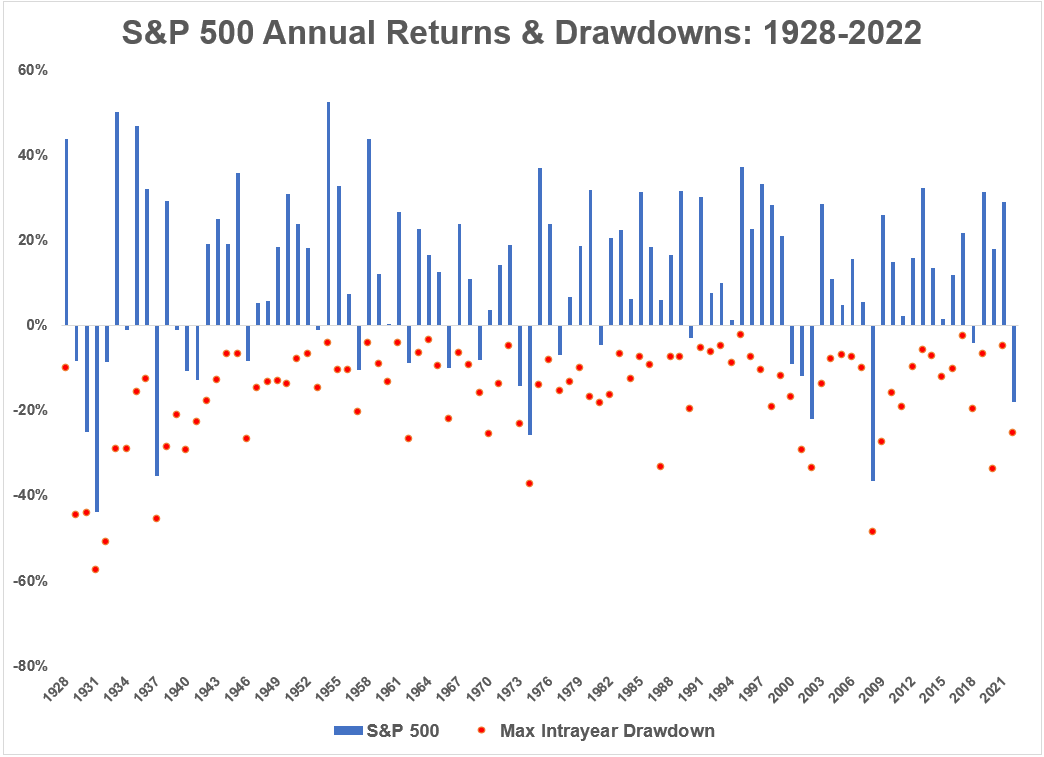

Although Chance rarely rears her head, these events happen few and far between. Ben Carlson reflects on last year’s performance as the 7th worst loss since the ‘20s. However, he makes an intriguing call here:

The only Wall Street strategist-type forecast I’m willing to make is this: The stock market will have a correction in 2023.

I’m not exactly going out on a limb here for one simple reason — the stock market has a correction every year.

Don’t waste time fighting the inevitable.

Carlson later reminds us, “time is your friend when it comes to investing in risk assets… If you have the ability to be patient, the expected returns for financial assets should be higher now than they were a year ago.”

Who knows what the future has in store for us?

Incredibly intelligent AI who will do your kid’s homework? People being themselves on Twitter? Personal robot assistants? I don’t know, but I can only hope it’s all for the better. But if there’s one thing I do know is that we will see some combination of 2021 and 2022, euphoria and misery again and again and again.

Many of us will be considered lucky to make it to 85. Luckier beyond that. We won’t even be able to recount what the markets did—your highest or lowest investment balances—hell, what clothes you’re wearing today. But what will stick will be the choices we make and the memories we create along the way.

It’s best to make those moments worthwhile.

I still keep my first few terrible posts up to remind myself of the progress I have made since that day. And two, that one great or terrible post doesn’t define the rest of them. But the collection of well-thought-out, well-written ideas, consistently over time, will bring me further to who and where I want to be. That, too, is a wager I’m willing to make.

When placing bets on your future, don’t get blocked by anxiety or your own inner dialogue.

If Linda can do it, then we all can get back on the skis.